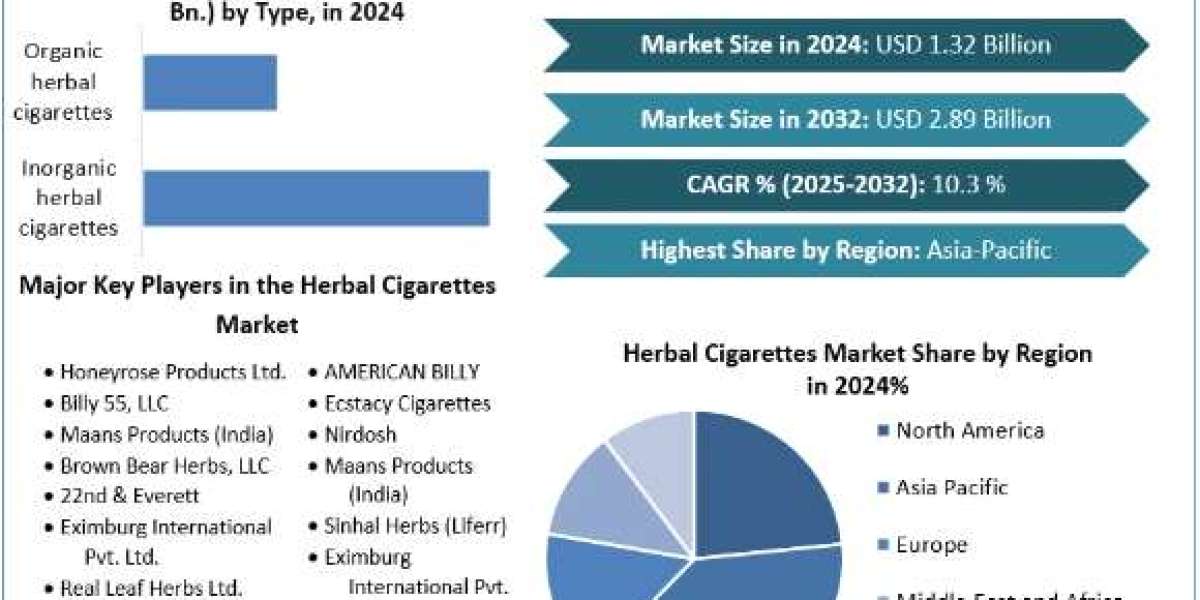

Herbal Cigarettes Market size was valued at USD 1.32 Bn. in 2024 and the total Herbal Cigarettes revenue is expected to grow at a CAGR of 10.3% from 2025 to 2032, reaching nearly USD 2.89 Bn. by 2032.

Market Estimation & Definition

Herbal cigarettes are smokeable sticks fashioned from botanical ingredients—such as clove, mint, basil, green tea, and other aromatic herbs—blended without nicotine or tobacco leaf. While they still produce smoke and are not risk-free, these products address two key consumer segments:

Smoking-cessation seekers who want a behavioural substitute for conventional cigarettes while avoiding nicotine.

Lifestyle users who view herb-based smokes as a more natural, flavour-rich alternative that aligns with wellness values.

The latest market sizing combines bottom-up sales channel data with top-down macro modelling across five world regions, covering historical performance from 2019 through 2024 and projecting revenue growth to 2032.

Grab your free sample copy of this report today! https://www.stellarmr.com/report/req_sample/Herbal-Cigarettes-Market/1981

Market Growth Drivers & Opportunity

Health-centred consumer shift – Heightened awareness of smoking’s health risks is propelling users to experiment with options marketed as “tobacco-free” or “nicotine-free.” Herbal cigarettes, though still subject to caution, benefit from a perception of reduced chemical load.

Perceived harm-reduction positioning – Brand messaging often emphasises the absence of tar, nicotine, and hundreds of tobacco-associated chemicals. Even though regulators stress that any smoke inhalation carries risk, the relative-risk narrative resonates with quit-minded smokers.

Flavour innovation – Companies are launching blends that range from cooling mint to spiced clove and calming green-tea infusions, alongside boutique mixes of lavender, rose, or yerba mate. Novel flavours help brands stand out and command premium shelf space.

E-commerce and specialty retail expansion – Direct-to-consumer websites, wellness shops, and “smoke-free” concept stores increase visibility and bypass many of the strict point-of-sale rules governing tobacco products.

Regulatory head-start – In numerous jurisdictions, herbal cigarettes face lighter excise taxes, warning-label requirements, and advertising limits than conventional tobacco. While regulatory tightening is possible, the current landscape favours innovation and rapid market entry.

Segmentation Insights

Product formats span totally tobacco-free sticks, hybrid herbal-plus-tobacco blends for gradual transition, and specialty botanical rolls aimed at the aromatherapy market. Fully herbal variants represent the lion’s share by unit volume thanks to their nicotine-free claim.

Distribution channels are led by online retail, where detailed ingredient information and wellness messaging can be communicated freely. Brick-and-mortar growth is strongest in modern convenience stores and premium lifestyle boutiques that curate alternative wellbeing products.

Flavour profiles have progressed from classic clove toward a spectrum of herbal choices—peppermint, basil, chamomile, raspberry leaf, and proprietary “signature spice” mixes—catering to regional palates and targeting former menthol-cigarette users still seeking a cooling sensation.

To find more information about this research, please visit: https://www.stellarmr.com/report/Herbal-Cigarettes-Market/1981

Country-Level Analysis

United States – North America remains the largest single market. A strong consumer pivot toward organic and holistic goods, coupled with extensive online retail infrastructure, drives steady uptake. Recent state-level flavour restrictions on vaping and menthol cigarettes are indirectly boosting curiosity for non-tobacco, flavoured herbal smokes sold both online and through CBD-focused stores.

Germany – Germany leads continental Europe for herbal cigarette adoption. Well-established health-food chains, an open attitude toward phytotherapy, and robust smoking-cessation programmes have created fertile ground for botanical brands. Regulatory authorities require clear labelling but, so far, do not tax herbal smokes at tobacco-equivalent levels—preserving a mainstream price point.

United Kingdom – The UK displays the fastest growth trajectory in Europe, fuelled by vigorous anti-tobacco campaigns and a thriving independent retail scene. Modern convenience chains have begun stocking herb-based products alongside nicotine-replacement therapies, while online sales jump during “Stoptober” and New-Year quit seasons.

Asia-Pacific – Although still emerging, markets such as South Korea and Australia show interest through pop-culture influences and wellness trends. Local manufacturers are experimenting with ginseng and green-tea blends tailored to regional tastes.

Competitor (Commutator) Landscape

Established leaders like Honeyrose Products, Brown Bear Herbs, Billy 55, and Maans Products boast decades of formulation know-how, wide-ranging flavour catalogues, and strong export footprints.

Fast-rising disruptors—including boutique labels such as Magic Dragon Smoke Shop and several eco-friendly start-ups—compete by highlighting organic certification, artisanal small-batch production, and recyclable packaging.

Strategic themes shaping competition:

R&D investment in new botanical blends and combustion-temperature control to improve taste and perceived smoothness.

E-commerce differentiation through subscription boxes and custom mix-and-match flavour packs.

Regulation-ready pivoting: companies are diversifying into herbal vapes, teas, and aromatherapy products in case future smoke-free legislation becomes stricter.

Supply-chain localisation to secure herb sourcing, minimise tariffs, and meet “grown and made locally” consumer preferences.

Discover What's Trending :

Soybean Oligosaccharides Market https://www.stellarmr.com/report/Soybean-Oligosaccharides-Market/1553

Chocolate Cocoa Beans Lecithin Sugar And Vanilla Market https://www.stellarmr.com/report/Chocolate-Cocoa-Beans-Lecithin-Sugar-and-Vanilla-Market/1722

Press-Release Conclusion

With a projected rise from USD 1.32 billion to nearly USD 3 billion by 2032, the herbal cigarettes market stands at the intersection of wellness culture, smoking-cessation efforts, and flavour-driven consumer experimentation. Brands that develop science-backed formulations, transparent labelling, and omnichannel reach will be positioned to capture the expanding pool of smokers seeking tobacco-free rituals.

Nevertheless, sustained growth depends on navigating evolving health-authority scrutiny and educating consumers on realistic risk profiles. Forward-thinking players are already broadening product portfolios—into herbal vapes, nicotine-free snus, and botanical inhalers—to stay ahead of regulatory curveballs and lifestyle trends.

About Stellar Market Research:

Stellar Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include science and engineering, electronic components, industrial equipment, technology, and communication, cars, and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Stellar Market Research:

S.no.8, h.no. 4-8 Pl.7/4, Kothrud,

Pinnac Memories Fl. No. 3, Kothrud, Pune,

Pune, Maharashtra, 411029

+91 20 6630 3320, +91 9607365656