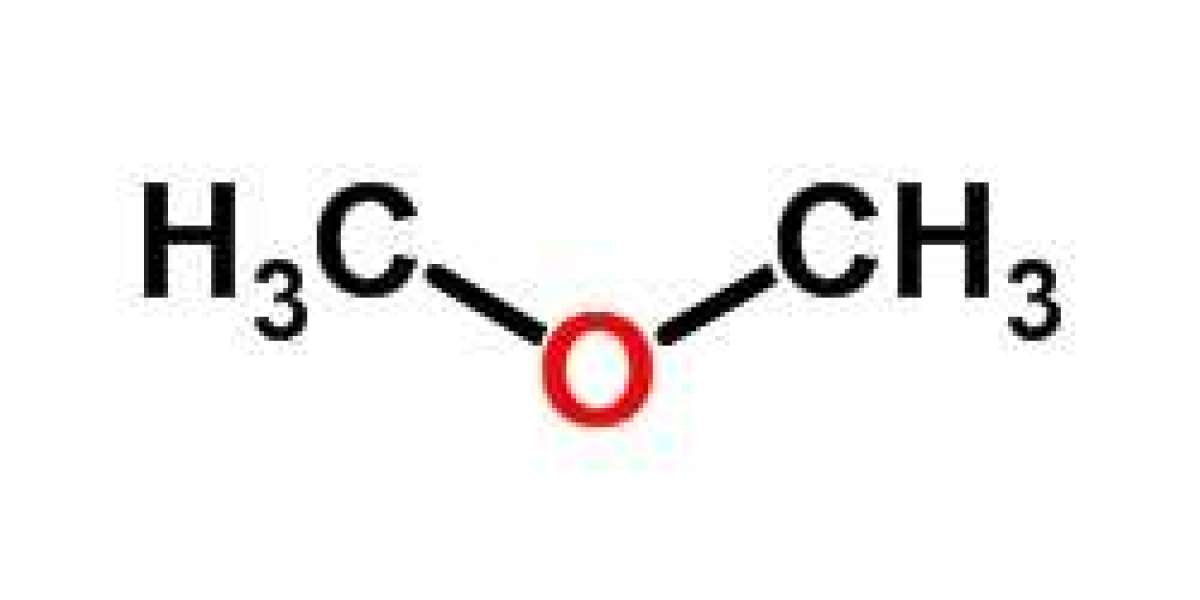

According to IMARC Group's latest research publication, "India Dimethyl Ether Market Size, Share, Trends and Forecast by Raw Material, Application, End-Use Industry, and Region, 2025-2033", the India dimethyl ether market size reached USD 266.40 Million in 2024. Looking forward, the market is expected to reach USD 765.22 Million by 2033, exhibiting a growth rate of 3.70% during 2025-2033. The report presents a thorough review featuring the India Dimethyl Ether Market Outlook, share, trends, and research of the industry.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report:

https://www.imarcgroup.com/india-dimethyl-ether-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the India Dimethyl Ether Market

- Rising Demand for Clean Alternative Fuels Driving Market Expansion

India's dimethyl ether market is experiencing a powerful transformation as the country aggressively pursues cleaner energy alternatives to tackle its dual challenge of rising fuel import bills and mounting environmental concerns. DME is emerging as a game-changing solution—a clean-burning, sulfur-free fuel that's capturing attention across transportation and domestic sectors. What makes this particularly exciting is the government's serious commitment to the methanol economy. The Department of Science & Technology launched its comprehensive Methanol Economy Research Programme back in 2015, recognizing that methanol and DME could play pivotal roles in containing India's rising petroleum imports while improving energy security. The program focuses on producing methanol from indigenous sources—Indian coal and captured CO2 from thermal plants and steel facilities—creating a circular economy approach that addresses both raw material availability and emission reduction. The numbers tell a compelling story about government ambition. India announced plans to establish three coal gasification plants dedicated to methanol and DME production, backed by USD 1 billion in investment. This infrastructure push aims to reduce fuel imports substantially while promoting indigenous technology development. The Bureau of Indian Standards has already approved standards for blending DME at 20% with LPG—a significant regulatory milestone that paves the way for commercial adoption. State-run refiner Indian Oil Corporation, working alongside the National Chemical Laboratory in Pune, is executing a pilot project to produce DME from methanol, starting with 200-300 tons annually before scaling to 500 tons. The transportation sector sees DME as particularly promising because of its high cetane number and low particulate emissions, making it an attractive diesel alternative. Researchers at IIT Kanpur, supported by the Science and Engineering Research Board under the Department of Science & Technology, successfully developed India's first 100% DME-fueled tractor, demonstrating higher thermal efficiency and lower emissions compared to baseline diesel engines. This breakthrough opens possibilities for agricultural mechanization powered by indigenous, renewable fuel. Cairn Oil & Gas became India's first oil producer to partner with UNEP's Oil and Gas Methane Partnership 2.0, committing to methane reduction with a 5-year target aligned with Net Zero Carbon goals. What's driving sustained interest is DME's compatibility with existing infrastructure—blending it with LPG requires no modifications to pipelines, storage facilities, or cylinders, making adoption economically feasible. The potential savings are substantial too; a 20% DME-LPG blend could reduce cylinder costs by approximately 200 rupees, making cooking fuel more affordable for millions of households.

- Expanding Applications Beyond Fuel: Aerosols and Chemical Synthesis Creating New Opportunities

The dimethyl ether market in India is diversifying rapidly beyond its fuel applications, with aerosol propellants and chemical synthesis emerging as significant growth drivers that are reshaping demand patterns across industries. DME's environmental credentials as a propellant with low global warming potential have made it increasingly attractive to manufacturers in personal care, cosmetics, pharmaceuticals, and household products. Unlike traditional propellants that contribute to atmospheric warming, DME offers comparable performance with minimal environmental impact—a combination that's proving irresistible as regulatory frameworks tighten and consumer awareness grows. India's expanding middle class, with rising disposable incomes and increasing exposure to international beauty and personal care standards, is driving tremendous growth in the cosmetics and healthcare sectors. These industries are actively reformulating products to incorporate DME-based aerosol systems, responding both to regulatory pressure and consumer preference for environmentally responsible products. The shift is accelerating as multinational companies establish and expand manufacturing operations in India, bringing global best practices and standards that favor low-emission propellants. The chemical manufacturing sector presents equally compelling opportunities. DME serves as a valuable intermediate in producing dimethyl sulfate, acetic acid, and various specialty chemicals—applications that are gaining momentum as India strengthens its domestic chemical manufacturing capabilities. The government's Production-Linked Incentive scheme for chemicals has created favorable conditions for capacity expansion, with companies investing heavily in establishing integrated manufacturing facilities that can produce DME and derivative chemicals efficiently. Major chemical manufacturers are recognizing DME's potential to reduce import dependence while accessing a versatile building block for multiple chemical pathways. Balaji Amines, one of India's leading specialty chemicals manufacturers, is executing a DME project at their Unit-IV facility in Solapur, Maharashtra, targeting commissioning by the end of the financial year. The project specifically addresses aerosol industry requirements while positioning DME as an LPG replacement for industrial and commercial usage. With the Bureau of Indian Standards approving 20% DME-LPG blending standards, Balaji's timing aligns perfectly with market readiness. The company's investment reflects broader industry confidence in DME's commercial viability across multiple applications. What's particularly interesting is the emergence of bio-based DME production pathways. As sustainability becomes central to corporate strategies, companies are exploring renewable feedstocks—agricultural waste, municipal solid waste, and low-value biomass—to produce methanol and subsequently DME. This approach not only addresses environmental concerns but also creates value from waste streams while reducing dependence on fossil fuel-derived feedstocks. The CSIR-Indian Institute of Chemical Technology partnered with Bharat Heavy Electricals Limited under the Department of Science & Technology's Carbon Capture and Utilization initiative to develop technology converting captured CO2 into DME. This project represents India's commitment to circular economy principles, enabling sustainable fuel production while addressing industrial emissions. Despite promising developments, challenges remain. Methanol price fluctuations impact DME production economics significantly, since methanol serves as the primary feedstock. Regulatory compliance requirements for aerosol-grade DME demand rigorous quality control and testing protocols that add costs. Infrastructure limitations—particularly around storage, handling, and distribution—require substantial capital investment before DME can achieve widespread adoption across industrial applications. Nevertheless, market momentum is building as technology providers, chemical manufacturers, and end-users collaborate to address these barriers systematically.

Key Trends in the India Dimethyl Ether Market

- Regional Distribution and Infrastructure Development Shaping Market Access

India's dimethyl ether market displays interesting regional dynamics influenced by industrial concentration, infrastructure availability, and policy support at state levels. The market is divided into four major regions—North India, South India, East India, and West India—each presenting distinct opportunities and challenges. North India benefits from strong government support and proximity to coal reserves, making it strategically important for coal-to-methanol-to-DME production pathways. States like Uttar Pradesh and Madhya Pradesh, with their substantial coal deposits, are natural candidates for integrated gasification facilities. Delhi's position as a policy hub means regulatory developments often emerge from this region first, with pilot projects and government initiatives frequently centered here. The National Chemical Laboratory's DME pilot project in Pune positions West India as a technology development hub. Maharashtra and Gujarat, with their advanced chemical manufacturing infrastructure and industrial clusters, provide ideal conditions for DME production and consumption. These states house numerous specialty chemical manufacturers, pharmaceutical companies, and consumer goods producers—all potential DME consumers for various applications from chemical feedstock to aerosol propellants. South India's strength lies in its advanced automotive and manufacturing sectors. States like Karnataka, Tamil Nadu, and Andhra Pradesh host major automobile manufacturers and ancillary industries that could adopt DME as an alternative fuel for commercial vehicles and industrial applications. The region's relatively developed infrastructure for industrial gases and chemicals facilitates easier integration of DME into existing supply chains. East India presents unique opportunities around utilizing coal resources from Jharkhand, Odisha, and West Bengal. The region's concentration of steel plants and thermal power stations—sources of industrial CO2 emissions—makes it attractive for carbon capture and utilization projects that convert emissions into DME. Infrastructure development remains crucial across regions. Cold chain logistics, specialized storage facilities, and distribution networks need substantial enhancement to support DME commercialization. The government's focus on developing industrial corridors and special economic zones provides opportunities to integrate DME infrastructure from the planning stage rather than retrofitting existing facilities. State-level incentives matter considerably. Maharashtra's decision to grant Mega Project status to Balaji Speciality Chemicals Limited's expansion project involving specialty chemicals reflects how progressive state policies can accelerate investment. The project, valued at 750 crores, benefits from incentives under the Packaged Scheme of Incentives 2019, demonstrating how state-level support complements national initiatives.

- Raw Material Diversity Creating Production Flexibility and Strategic Advantages

One of DME's most compelling advantages in the Indian context is production flexibility across multiple feedstock options—methanol, coal, natural gas, bio-based materials, and other sources. This diversity reduces supply chain vulnerabilities while enabling producers to optimize costs based on regional resource availability. Methanol remains the primary pathway currently, with established dehydration technologies that convert methanol efficiently into DME. India's methanol market dynamics directly influence DME production economics. The country currently imports substantial methanol volumes, but domestic production is expanding. Coal gasification offers particularly attractive opportunities given India's significant coal reserves. Converting coal to syngas, then to methanol, and finally to DME creates an integrated value chain that leverages indigenous resources while reducing import dependence. The government's push for coal gasification aligns perfectly with DME production ambitions, with projects specifically targeting this pathway. Natural gas-based production presents another viable route, especially in regions with gas infrastructure. While India's domestic natural gas availability remains constrained, LNG imports and pipeline networks in certain regions make gas-to-methanol-to-DME pathways economically feasible for specific locations. Bio-based feedstocks represent the most exciting long-term opportunity. Agricultural residue burning remains a significant environmental concern, particularly in North India. Converting crop waste, sugarcane bagasse, and other agricultural byproducts into bio-DME addresses waste management while creating valuable energy products. Municipal solid waste gasification offers similar benefits, tackling urban waste problems while producing clean fuel. These bio-based pathways align with India's broader circular economy and waste-to-energy initiatives. The flexibility to switch between feedstocks based on availability and pricing provides strategic advantages for producers. Integrated facilities can optimize production based on feedstock costs, seasonal availability, and market demand for different DME applications. This adaptability becomes particularly valuable in India's dynamic regulatory and pricing environment where coal policies, natural gas pricing, and import duties can shift based on government priorities. Technology partnerships are accelerating capability development. Companies are licensing proven technologies while simultaneously investing in indigenous research. The collaboration between CSIR-IICT and BHEL on CO2-to-DME conversion exemplifies how research institutions and equipment manufacturers are combining expertise to develop India-specific solutions that address local conditions and resource availability.

- Balancing Multiple End-Use Industries: From Automotive to Cosmetics

India's DME market serves an increasingly diverse set of end-use industries, each with distinct requirements, growth trajectories, and adoption drivers. This segmentation across oil and gas, automotive, power generation, cosmetics, and other sectors creates both complexity and opportunity for market participants. The oil and gas sector leads current consumption, primarily through LPG blending applications. With India importing substantial LPG volumes to meet domestic cooking fuel demand, blending DME offers immediate import substitution benefits. The 20% blending target approved by BIS could translate to significant DME demand once implementation scales beyond pilot projects. State-run oil companies are positioned to drive this adoption given their distribution infrastructure and government mandates around fuel self-sufficiency. The automotive industry presents transformative potential but faces longer commercialization timelines. While DME's diesel-like properties make it attractive for compression ignition engines, widespread adoption requires engine modifications, fuel system redesigns, and extensive field testing. The IIT Kanpur tractor demonstrates technical feasibility, but scaling to commercial vehicle fleets demands substantial investment from automobile manufacturers and fuel suppliers. Heavy-duty trucks, buses, and agricultural equipment represent logical starting points given their concentrated refueling patterns and diesel cost sensitivity. Power generation applications remain relatively nascent but hold promise, particularly for distributed generation and off-grid applications where DME's clean combustion characteristics and fuel handling simplicity offer advantages over diesel generators. As India expands rural electrification and backup power installations, DME-based generation could find niche applications. The cosmetics and personal care sector offers stable, growing demand less dependent on infrastructure development. As manufacturers reformulate aerosol products using DME propellants, volumes may be smaller than fuel applications but margins are typically better, and growth is more predictable. This sector values consistent quality and reliable supply more than absolute price minimization, making it attractive for DME producers seeking diversified revenue streams. Other applications span industrial solvents, refrigerants, and specialty chemical intermediates. While individually smaller, these applications collectively contribute meaningful volume while demonstrating DME's versatility. Companies like Balaji Amines targeting multiple end-use segments exemplify how integrated manufacturers can optimize production across varied applications with different quality specifications and pricing dynamics. The challenge for the DME industry is managing these parallel tracks—investing in infrastructure for fuel applications while serving current aerosol and chemical markets, all while preparing for future automotive adoption. Success requires balancing immediate commercial opportunities with longer-term transformational applications that could dramatically scale volumes but demand patient capital and sustained policy support.

Leading Companies Operating in the India Dimethyl Ether Market:

The India dimethyl ether market features a mix of domestic chemical manufacturers, technology providers, and international players investing in production and distribution capabilities. Major participants are expanding capacities and developing applications across fuel, aerosol, and chemical synthesis segments.

India Dimethyl Ether Market Report Segmentation:

Breakup by Raw Material:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

Breakup by Application:

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

Breakup by End-Use Industry:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

Regional Insights:

- North India

- South India

- East India

- West India

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly:

https://www.imarcgroup.com/request?type=report&id=30515&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302