In today's rapidly evolving business landscape, compliance with government regulations is crucial for businesses of all sizes. For businesses in Nepal, one of the most important aspects of running a successful operation is adhering to tax and billing laws enforced by the Inland Revenue Department (IRD). This is where IRD-compliant billing software comes into play. In this blog, we’ll explore why your business needs IRD-compliant billing software and how it can benefit your operations in Nepal.

Introduction

Every business, whether small or large, needs to maintain a smooth and efficient billing process. However, what many businesses overlook is the necessity of adhering to government regulations, especially when it comes to taxes and invoicing. For businesses operating in Nepal, this means ensuring that their billing processes are IRD-compliant.

The Inland Revenue Department (IRD) of Nepal is responsible for collecting taxes and ensuring that businesses meet tax obligations. To streamline this process, the IRD has set specific guidelines for businesses to follow when issuing invoices and billing clients. This has made it essential for businesses to use IRD-compliant billing software that not only helps them meet these regulatory requirements but also improves their overall efficiency and transparency.

In this blog, we will dive into the benefits of IRD-compliant billing software and why it’s a must-have tool for your business in Nepal.

What Is IRD-Compliant Billing Software?

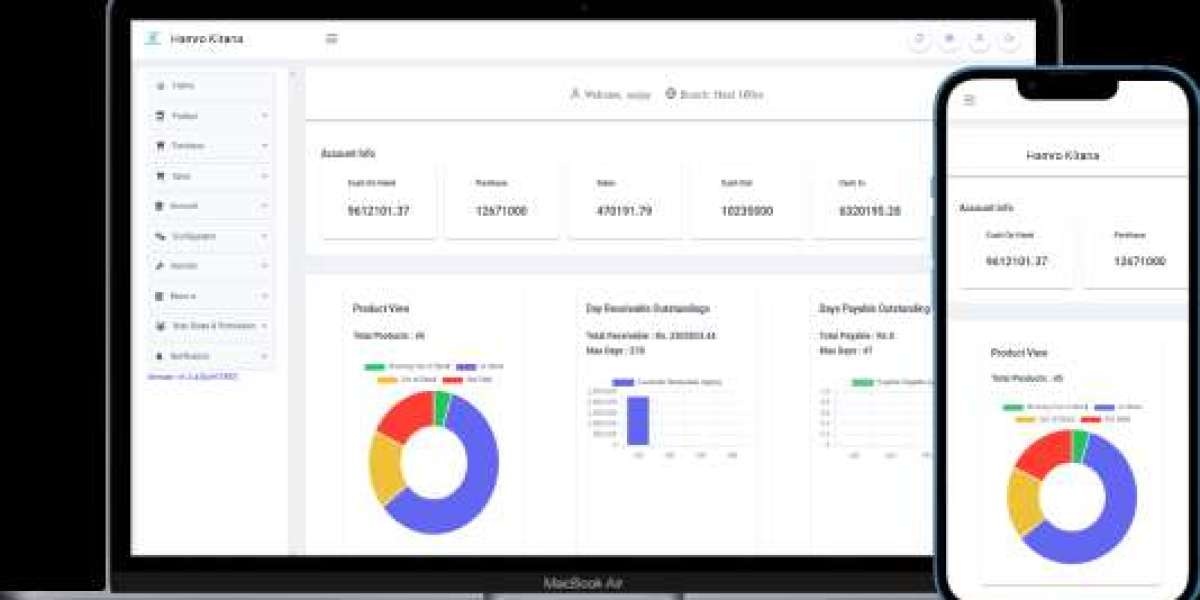

IRD-compliant billing software is a digital tool designed to help businesses generate invoices and manage their financial records in line with the standards set by the Inland Revenue Department of Nepal. The software is built to ensure that all invoices include the necessary details, such as tax identification numbers, tax rates, and other key information required by the IRD.

In addition to this, the software allows businesses to generate and store invoices in a format that is easy for the IRD to audit, ensuring that your business remains compliant and transparent in its financial dealings. The IRD-compliant nature of the software ensures that businesses meet local tax regulations without facing penalties or fines.

Key Features of IRD-Compliant Billing Software

When you choose billing software for your business in Nepal, it’s essential to look for specific features that ensure compliance with IRD guidelines. Here are some key features to look for:

1. Tax Calculation and Invoicing

A core feature of IRD-compliant billing software is the ability to calculate taxes automatically. In Nepal, businesses must adhere to the Value Added Tax (VAT) system, which means calculating VAT for every transaction. The software should automatically calculate VAT based on the sales price, reducing the risk of human error.

The software should also allow you to generate invoices that clearly display the tax amount and the total due, making it easy for both your business and your clients to understand the transaction.

2. Tax Identification Number (TIN)

In Nepal, every business is assigned a Tax Identification Number (TIN) by the IRD. This number must be included on all invoices issued by your business. IRD-compliant billing software ensures that your TIN is automatically included on all invoices, preventing the risk of missing this important detail.

3. Simplified Reporting

IRD-compliant billing software simplifies tax reporting by automatically generating reports that align with the tax regulations. These reports can be used to file tax returns and can be shared with the IRD for auditing purposes. The software should offer easy-to-use financial reports, including sales tax reports, transaction histories, and year-end financial summaries.

4. Automated Invoice Tracking

Tracking invoices manually can be time-consuming and error-prone. However, IRD-compliant billing software automates this process, making it easy to monitor outstanding invoices, due dates, and payments. This helps businesses maintain a clear overview of their cash flow and ensures that they never miss an important payment or deadline.

5. Digital Record Keeping

One of the key features of IRD-compliant billing software is the ability to keep digital records of all invoices and transactions. The IRD requires businesses to retain invoices for a set period, and digital record-keeping simplifies this process. You can easily access past invoices and financial records when needed, which is particularly useful during tax season or in case of an audit.

6. Support for Multiple Payment Methods

IRD-compliant billing software typically supports multiple payment methods, including cash, credit, and online payments. This flexibility allows businesses to cater to a wider range of customers, making transactions easier and more efficient.

The Importance of IRD Compliance for Your Business

Running a business involves managing a variety of responsibilities, but tax compliance should always be a top priority. Here’s why IRD compliance is crucial for your business in Nepal:

1. Avoid Penalties and Fines

The IRD enforces strict regulations for tax reporting and billing. If your business fails to comply with these regulations, it could face penalties and fines. Using IRD-compliant billing software ensures that your invoices are correctly formatted and that tax calculations are accurate, helping you avoid costly mistakes and legal trouble.

2. Streamline Financial Operations

Running a business means handling numerous financial transactions on a daily basis. Without the right tools in place, keeping track of invoices, payments, and taxes can become overwhelming. IRD-compliant billing software streamlines these processes by automating calculations, tracking payments, and organizing financial records. This not only saves you time but also reduces the risk of errors that can lead to financial loss or compliance issues.

3. Transparency and Trust with Customers

Customers expect transparency in their transactions. By using IRD-compliant billing software, your business can provide clear and accurate invoices that display all necessary tax details. This transparency helps build trust with your customers and enhances your business’s reputation.

4. Facilitate Tax Filing

Tax filing can be a complicated and time-consuming task, especially if you don’t have the right systems in place. IRD-compliant billing software simplifies the tax filing process by generating reports that align with the IRD’s requirements. With these reports at your disposal, you can file your taxes on time and without hassle.

5. Audit Readiness

In the event of an audit, businesses must provide accurate financial records to the IRD. IRD-compliant billing software ensures that your invoices are properly formatted and stored digitally, making it easy to access the necessary records during an audit. Having organized and compliant records makes the audit process smoother and less stressful.

How IRD-Compliant Billing Software Can Benefit Your Business

In addition to the compliance advantages, using IRD-compliant billing software offers numerous benefits that can improve your business’s operations:

1. Improved Efficiency

Automating tasks such as tax calculations, invoicing, and report generation increases the overall efficiency of your business. Your employees can spend less time on manual data entry and focus more on growing the business.

2. Cost-Effective

Although there is an upfront cost to purchasing and implementing billing software, it is a cost-effective solution in the long run. It reduces the likelihood of errors that could result in penalties, helps you avoid hiring additional staff for manual processes, and improves operational efficiency.

3. Better Customer Experience

With automated invoicing and easy payment tracking, your customers will experience a more seamless and professional service. A smooth billing process can enhance customer satisfaction and loyalty, which ultimately leads to business growth.

4. Scalability

As your business grows, managing invoicing and tax reporting becomes more complex. IRD-compliant billing software is scalable, meaning it can grow with your business. Whether you’re adding new customers or expanding to new markets, the software can accommodate your growing needs.

Conclusion

In conclusion, IRD-compliant billing software is essential for businesses operating in Nepal. Not only does it help ensure compliance with the Inland Revenue Department’s tax regulations, but it also enhances operational efficiency, customer trust, and financial transparency. Whether you’re a small business owner or managing a larger operation, investing in the right billing software can help streamline your financial processes, save you time, and prevent costly mistakes.

For businesses in Nepal, staying on top of tax compliance and billing regulations is crucial for success. By adopting IRD-compliant billing software, you can focus more on growing your business while ensuring you meet all necessary legal requirements. Don’t wait—upgrade to IRD-compliant billing software today and experience the benefits for yourself.