Making investments on behalf of investors is something MFDs do day in and day out. It’s part of your daily job, right? From selecting the right fund to aligning it with your client’s goals, you're constantly at it.

But let’s be honest, doing it all manually takes time, leaves room for error, and drains energy.

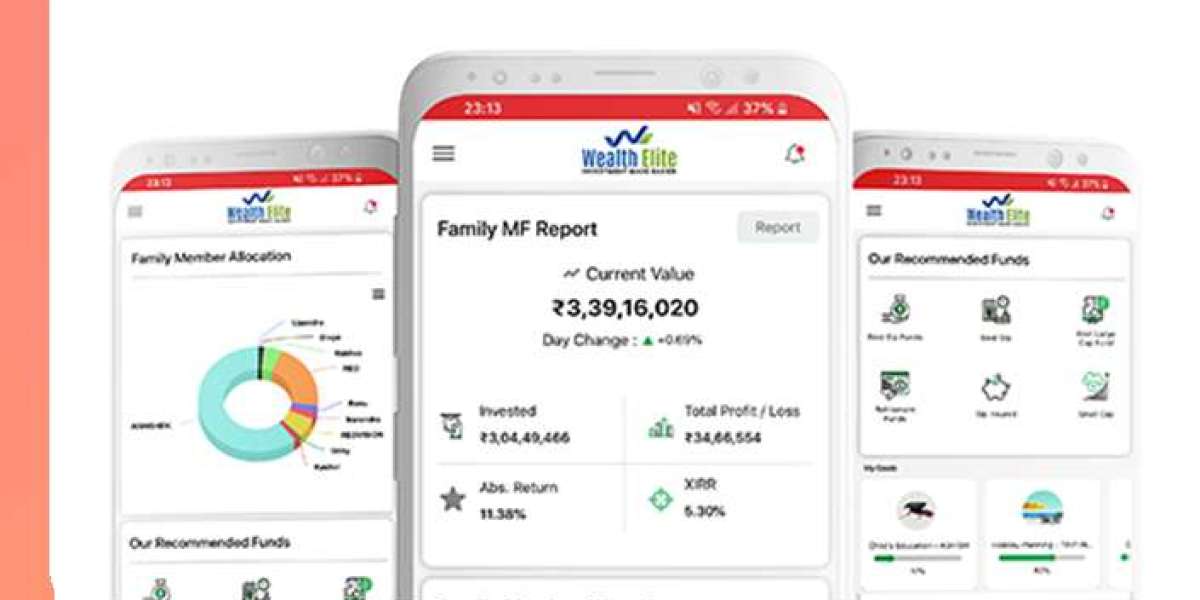

That’s why Mutual Fund Software is quickly becoming the go-to tool for MFDs across India. It’s not just about convenience, it’s about making smarter, data-backed, goal-aligned investment decisions easier and faster. Let’s break it down.

How Mutual Fund Software Helps With Investment Research

Investment research isn’t just about looking up returns anymore. Today, clients want goal-based planning, future projections, comparisons, and more. This is where software steps in.

Most leading back office software today offers powerful research tools, such as:

Built-in Calculators for Goal-Based Planning

These calculators in the best mutual fund software do the heavy lifting:

● SIP Calculator: Shows how much your client needs to invest monthly.

● SWP Calculator: Helps plan withdrawals for retired clients.

● Step-Up SIP Calculator: Plans increasing SIPs year on year.

● Retirement Planning Calculator: Projects the corpus needed post-retirement.

● Marriage Planning Calculator: Helps plan long-term savings for children’s marriage.

● Child’s Education Calculator: Calculates inflation-adjusted future education costs.

These calculators aren’t just helpful. They’re client-friendly and help you explain complex ideas in a few clicks.

Advanced Tools for Scheme Selection

When comparing mutual fund schemes, it’s no longer about past performance alone, that's why portfolio management software offers:

● Fund Comparison Tool: Compare up to 5 schemes side-by-side

● Fund Factsheets: Detailed analysis of fund performance, expense ratio, risk ratios, and holdings

● Portfolio Overlap Tool: See how similar different schemes are in terms of underlying stocks

● Risk-Return Snapshot: Get a quick view of how aggressive or balanced a scheme is

These tools help you go beyond instinct and back your decisions with clear data.

How It Minimizes Errors & Saves Your Time

Let’s face it, manual work leads to mistakes. And with so many client portfolios to handle, even small errors can be costly.

Using software means:

● Zero Manual Calculations: Say goodbye to Excel formulas and calculator apps.

● Inbuilt Validations: You get alerts for missing data or inconsistencies.

● Auto-Suggestions: The software suggests ideal schemes based on client goals and risk profiles.

● Quick Comparison & Analysis: No more switching tabs and checking multiple websites.

More importantly, it saves time, and as an MFD, your time is money.

What This Means for Your Business

Having the right software is like having a research assistant, calculator, and analyst all rolled into one. Here’s what that means for your business:

● Faster Turnaround Time: Respond to client queries in minutes, not hours

● Better Client Experience: Goal-based planning feels professional and organised

● More Conversions: When you show data-backed advice, clients say yes faster

● Less Stress, More Scale: Spend less time on manual work and more on growing your business

Imagine handling 10 clients the way you handle 2 today. That’s what software helps you do.

Final Thoughts

You already know how to guide investors. But having the right tools makes it easier, faster, and sharper. Software doesn’t replace your experience. It complements it. It simplifies research, speeds up planning, reduces manual tasks, and most importantly, it helps you serve better.

So the question isn’t "Should I use software?" It’s "Which software helps me serve my investors best?"