IMARC Group has recently released a new research study titled “Mexico Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2025-2033 ”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

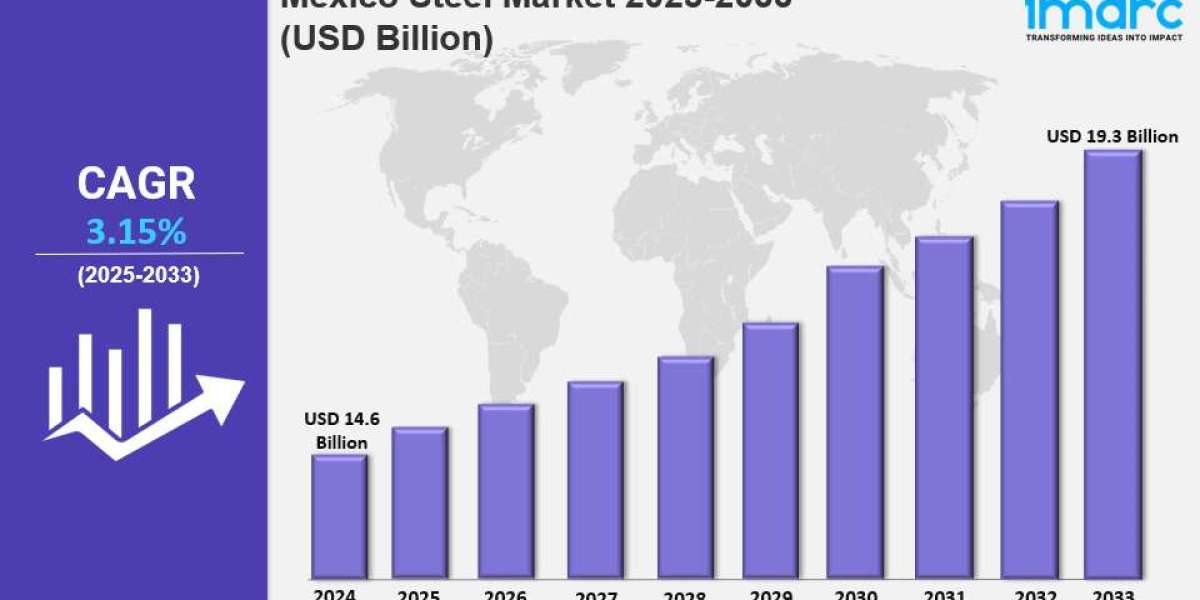

The Mexico steel market size reached USD 14.6 Billion in 2024 and is expected to grow to USD 19.3 Billion by 2033, reflecting a CAGR of 3.15% between 2025 and 2033. This growth is driven by rising infrastructure investments, especially in transportation and construction, and increasing demand from the automotive sector, particularly for electric vehicles.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Steel Market Key Takeaways

- Current Market Size: USD 14.6 Billion in 2024

- CAGR: 3.15% during 2025-2033

- Forecast Period: 2025-2033

- The market is supported by increased infrastructure spending including highways, bridges, and railways.

- The automotive industry's shift toward electric vehicles has increased demand for specialist high-strength steel.

- USMCA trade deal enhances Mexico's steel production capacity and tariff-free access to North American markets.

- Steel market segments include type, product, and application with detailed analyses provided for each.

Sample Request Link: https://www.imarcgroup.com/mexico-steel-market/requestsample

Mexico Steel Market Growth Factors

Mexico’s steel market benefits significantly from growing infrastructure investments, which have raised steel demand. Government initiatives to upgrade transportation networks—such as highways, bridges, and railways—along with growth in residential and commercial construction, fuel sustained steel consumption. Urban development and public transit projects further support this trend, as expanding sectors like construction, energy, and transportation drive robust demand for steel, bolstering the industry's role in Mexico's economic progression.

Demand from the automotive sector also strengthens the steel market. High-strength steel is increasingly used in automotive bodies, chassis, and engines, with the rise in electric vehicle (EV) production boosting the need for specialized steel grades and manufacturing technologies. November 2024 saw a 41.1% year-on-year increase in hybrid and electric vehicle sales to 12,147 units, underscoring strong market momentum. This sector promotes innovation in steel products emphasizing lightweight, durable, and energy-efficient materials, enhancing Mexico’s automotive exports and competitiveness.

Trade relations under USMCA significantly influence Mexico’s steel market by enabling tariff-free access to the U.S. and strengthening production capabilities. Despite a 13% decrease in steel exports to the U.S. in 2024 compared to 2015, USMCA supports investment in new plants and production technology. The agreement promotes innovation in steel grades and processing, elevates industry efficiency, and maintains Mexico's strong positioning in the North American steel market even amid recent challenges.

To get more information on this market, Request Sample

Mexico Steel Market Segmentation

Breakup By Type:

- Flat Steel: Flat steel is a primary category of steel products characterized by flat, rolled steel sheets utilized mainly in manufacturing and construction.

- Long Steel: Long steel includes products such as bars and rods predominantly used in construction and infrastructure development.

Breakup By Product:

- Structural Steel: Used in building frameworks, bridges, and industrial construction providing strength and durability.

- Prestressing Steel: Steel designed to withstand tension in concrete construction applications.

- Bright Steel: Finished steel products with smooth surfaces and suitable mechanical properties for various industrial uses.

- Welding Wire and Rod: Consumables used in welding processes for joining metal parts.

- Iron Steel Wire: Steel wire products applied in multiple industrial sectors.

- Ropes: Steel ropes used for lifting, rigging, and securing applications.

- Braids: Steel braids applied in specialized industrial processes requiring flexible yet strong materials.

Breakup By Application Insights:

- Building and Construction: Utilization of steel in infrastructure, residential and commercial buildings.

- Electrical Appliances: Steel used in manufacturing components of electrical devices.

- Metal Products: Steel applied in various metal goods production.

- Automotive: Use of steel in vehicle manufacturing.

- Transportation: Steel applications in transport infrastructure and vehicles.

- Mechanical Equipment: Steel used in machinery and mechanical systems.

- Domestic Appliances: Steel components in household appliances.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others constitute the major regional markets. The report does not specify dominant regions or detailed market statistics but provides a comprehensive analysis across these territories to understand regional demand dynamics.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=31677&flag=C

Recent Developments & News

In March 2025, Mexico’s steel industry announced an investment of USD 8.7 billion over the next five years to expand domestic production, despite a 25% U.S. tariff. Victor Martínez Cairo, president of the National Steel and Iron Industry Chamber (Canacero), confirmed commitment to the investment aligned with President Sheinbaum’s Plan México to strengthen steel capabilities. Also, Mexico initiated an anti-dumping investigation in March 2025 against hot-rolled steel imports from China and Vietnam, targeting exporters like Ansteel Group, Baosteel, and Formosa Ha Tinh, following allegations of below-market pricing harming Mexican producers.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302