IMARC Group has recently released a new research study titled “Mexico Food Sweetener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

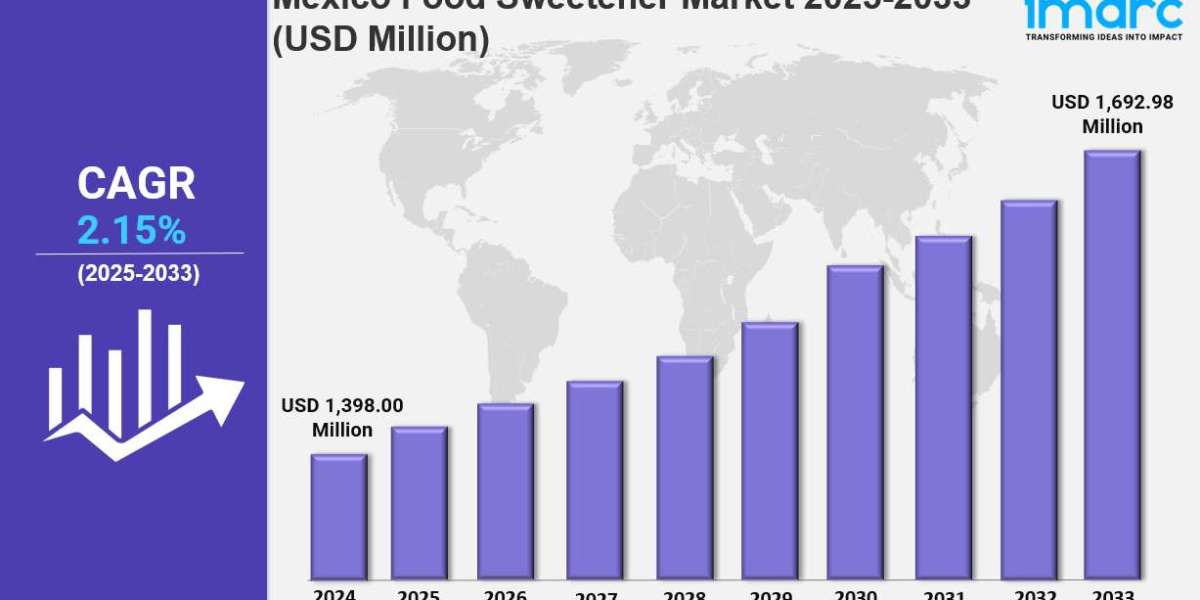

The Mexico food sweetener market size was valued at USD 1,398.00 million in 2024 and is projected to reach USD 1,692.98 million by 2033, growing at a CAGR of 2.15% during the forecast period 2025-2033. This growth is fueled by rising consumer demand for low-calorie and natural sweeteners, particularly plant-based alternatives like stevia and monk fruit. Innovation and regulatory support for healthier ingredients are expected to further enhance market growth. Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Mexico Food Sweetener Market Key Takeaways

- Current Market Size: USD 1,398.00 million in 2024

- CAGR: 2.15%

- Forecast Period: 2025-2033

- Growing consumer shift towards natural sweeteners such as stevia and monk fruit due to increasing health consciousness

- Rising incidence of obesity and diabetes driving demand for low-calorie and sugar-free sweeteners like erythritol and aspartame

- Innovation in product development focusing on mixtures of natural sweeteners and sugar alcohols to meet weight management and diabetes-related needs

- Expanding application across beverages, dairy, bakery, and other food categories

- Comprehensive competitive landscape analysis including company profiles

Sample Request Link: https://www.imarcgroup.com/mexico-food-sweetener-market/requestsample

To get more information on this market, Request Sample

Mexico Food Sweetener Market Growth Factors

The Mexico food sweetener market is witnessing steady growth primarily driven by the growing demand for natural sweeteners. Consumers in Mexico are becoming more health conscious due to health concerns related to high sugar intake such as obesity, diabetes, and metabolic disorders. Natural sweeteners like stevia and monk fruit offer low-calorie alternatives with a lower glycemic index, making them preferred choices. Stevia is favored for its zero-calorie sweetening capability without impacting blood sugar levels, while monk fruit is valued for its natural sweetness and antioxidant properties. This shift aligns with a global preference for clean-label and organic products, accelerating the demand for natural sweeteners in Mexico's food and beverage industries.

Rising health consciousness among Mexican consumers is significantly influencing their food and beverage preferences. Increasing awareness of obesity and diabetes has led to caution in sugar consumption and a surge in demand for low-calorie and sugar-free sweeteners such as erythritol and aspartame. These sweeteners provide sweetness without the calories and negative health effects associated with traditional sugar. The beverage sector notably mirrors this trend, with sugar-free sodas and health drinks becoming increasingly popular. The ongoing consumer transition towards healthier lifestyles propels the growth of sweeteners that aid in weight management and blood sugar control.

Innovation in product development is another major growth driver in the market. Mexican companies are focusing on creating healthier and consumer-friendly sweetening options. This includes developing blends of natural sweeteners like stevia and monk fruit and producing sugar alcohols such as erythritol, which provide sweetness with minimal effects on blood sugar. Innovations are also tailored to address specific consumer needs such as weight control, diabetes management, and the growing demand for clean-label products. Enhancements in product formulations are evident in diversified food segments including beverages, dairy, and bakery products, contributing to sustained market growth.

Mexico Food Sweetener Market Segmentation

Product Type Insights:

- Sucrose

- Starch Sweeteners and Sugar Alcohols

- High Intensity Sweeteners (HIS)

- Others

Description: The product segmentation categorizes sweeteners into sucrose, starch sweeteners and sugar alcohols such as dextrose, HFCS, maltodextrin, sorbitol, xylitol, and others, alongside high intensity sweeteners that include sucralose, stevia, aspartame, saccharin, neotame, ace-K, and others.

Application Insights:

- Bakery and Confectionery

- Dairy and Desserts

- Beverages

- Meat and Meat Products

- Soups, Sauces and Dressings

- Others

Description: Market applications are segmented into bakery and confectionery, dairy and desserts, beverages, meat and meat products, soups, sauces and dressings, and other food categories.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online Stores

- Others

Description: Distribution channels are classified as supermarkets and hypermarkets, departmental stores, convenience stores, online stores, and others.

Regional Insights

The report segments the Mexico food sweetener market into Northern Mexico, Central Mexico, Southern Mexico, and others. However, specific market share or CAGR data by region is not provided in the source. Hence, dominant region and exact regional statistics are not available.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=33678&flag=C

Recent Developments & News

In July 2024, Mexican sugar refiner Beta San Miguel (BSM) acquired 15.93% of Sucro Ltd.'s shares from SC Americas Corp. at $9 per share amounting to 3.75 million shares. BSM also secured a supply agreement with Sucro to strengthen its presence in North American markets. Additionally, in May 2024, Mexico and China announced a partnership to promote sustainable sugarcane farming in Mexican states Quintana Roo, Tabasco, and Campeche. This initiative aims to test innovative agricultural techniques on 40,000 to 50,000 hectares to improve food security against Mexico's low sugarcane harvest.

Key Players

- Beta San Miguel (BSM)

- Sucro Ltd.

- SC Americas Corp.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302