IMARC Group has recently released a new research study titled “United States Business Jet Market Size, Share, Trends and Forecast by Type, Business Model, Range, Point of Sale, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

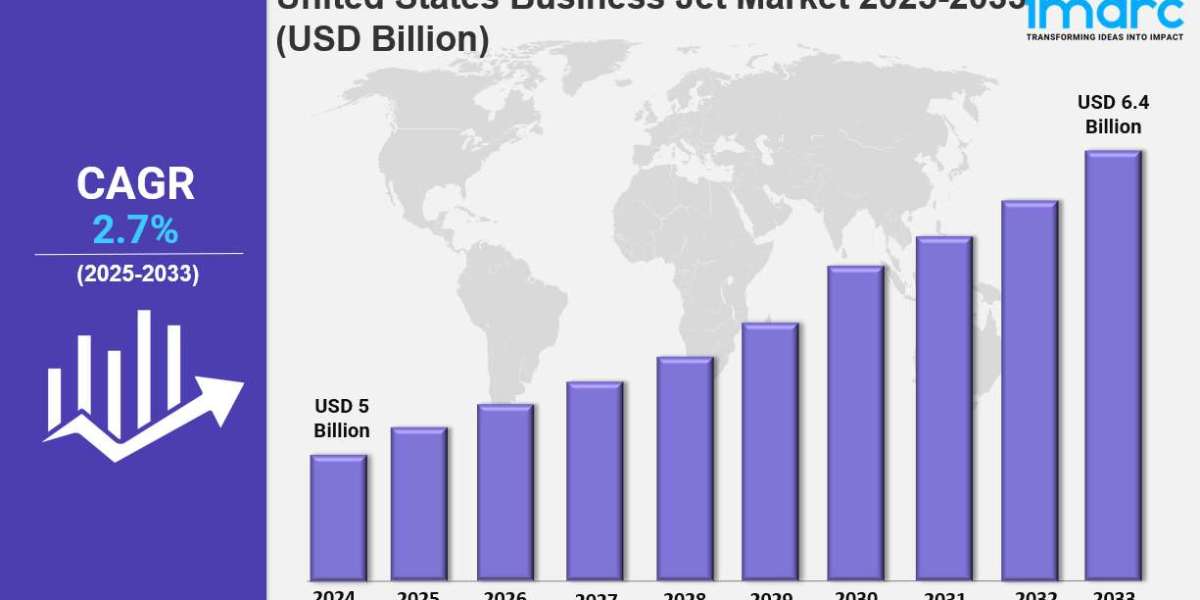

The United States business jet market size was valued at USD 5 Billion in 2024 and is projected to reach USD 6.4 Billion by 2033. The market is expected to grow at a CAGR of 2.7% during the forecast period of 2025-2033. Growth is driven by increasing demand for private air travel, corporate investments in modern fleets, and a shift toward safer and more efficient travel options.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

United States Business Jet Market Key Takeaways

- The United States business jet market size was USD 5 Billion in 2024.

- The market is expected to grow at a CAGR of 2.7% from 2025 to 2033.

- The forecast period for the market is 2025-2033.

- Increasing demand for private air travel mainly among high-net-worth individuals and corporate executives.

- Technological advancements such as enhanced fuel efficiency, safety, and modern amenities boost market growth.

- Corporate fleet modernization and growing fractional ownership programs contribute to expansion.

- The rise in on-demand charter services offers flexibility and convenience.

Sample Request Link: https://www.imarcgroup.com/united-states-business-jet-market/requestsample

To get more information on this market, Request Sample

United States Business Jet Market Growth Factors

The United States business jet market is growing due to increased demand for private air travel, especially among high-net-worth individuals (HNWIs) and corporate executives. These groups seek flexible, convenient, and private travel options, significantly valuing time savings and efficiency. The rise in the number of ultra-high-net-worth individuals (UHNWIs) further strengthens this demand. Corporate investments aim to reduce reliance on commercial flights and tailor schedules to executive needs, catalyzing market growth.

Technological innovations in business jets, such as improved fuel efficiency, advanced safety features like Emergency Autoland, and modern avionics (e.g., Garmin G3000 PRIME), enhance appeal. New models like Textron Aviation's Cessna Citation CJ4 Gen3, set to enter service in 2026, exemplify such advancements. These improvements reduce operating costs and improve performance, encouraging fleet modernization by corporations seeking competitive, efficient, and environmentally compliant aircraft.

Furthermore, the ongoing expansion of fractional ownership programs and charter flight sectors lowers barriers to access private aviation. On-demand services and jet-card programs provide flexible, cost-effective alternatives to full ownership, attracting a broader client base. The combination of luxury, convenience, and operational efficiency sustains demand growth for business jets amid rising global business activities and growing needs for faster, secure travel solutions.

United States Business Jet Market Segmentation

Analysis by Type:

- Light: Provide affordable, short- to medium-distance travel for 4–8 passengers, suitable for regional business travel with rapid turnaround and favored by entrepreneurs and small businesses.

- Medium: Designed for medium-haul flights carrying 7–9 passengers, balancing cost, range, and comfort; preferred by business leaders traveling between large cities with enhanced amenities.

- Large: Accommodate up to 18 passengers, designed for long-haul travel offering luxury features like private sleeping quarters and conference rooms, favored by wealthy individuals and major businesses.

Analysis by Business Model:

- On-Demand Service:

- Air Taxis: Enable rapid, short-distance urban travel, bypassing traffic with point-to-point service for quick transportation.

- Branded Charters: Offer tailored flight experiences for luxury and corporate travelers seeking privacy and comfort.

- Jet-Card Programs: Provide pre-paid flight access without ownership, offering usage flexibility and operational simplicity.

- Ownership:

- Fractional Ownership: Allows shared jet ownership to reduce costs while maintaining access to private jets.

- Full Ownership: Grants exclusive jet control with complete scheduling freedom, suited for high-frequency flyers and corporations.

Analysis by Range:

- < 3,000 NM: Efficient for short to medium domestic flights offering cost-effective regional travel options, popular due to compact size and affordability.

- 3,000 - 5,000 NM: Suitable for longer domestic and international trips, balancing size, range, and operational cost for companies with global operations.

- > 5,000 NM: Designed for long-haul international travel with nonstop connectivity and luxurious amenities, used by UHNWIs and large corporations.

Analysis by Point of Sale:

- OEM: Includes manufacturing and sales of new jets equipped with advanced technology and customization for corporate fleets, private owners, and charters.

- Aftermarket: Covers replacement parts, maintenance, and upgrades crucial for operational efficiency and compliance, catering to existing jet owners and operators.

Regional Insights

The report identifies the West region of the United States, particularly California, as a leader in the business jet market. This dominance is fueled by the concentration of tech giants, entertainment industries, and affluent individuals. Key cities like Los Angeles and San Francisco drive strong demand for private jets for both corporate and leisure travel, reflecting significant growth in private jet activity.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=20641&flag=C

Recent Developments & News

In October 2024, Gulfstream unveiled its G700 business jet featuring advanced Rolls-Royce Pearl 700 engines and luxury amenities such as a master suite and chef-friendly galley. The aircraft boasts a range of 14,353 km and a speed of Mach 0.935, with deliveries starting in 2026. Additionally, Textron Aviation introduced the Cessna Citation CJ4 Gen3, CJ3 Gen3, and M2 Gen3 jets during NBAA-BACE 2024, showcasing Garmin emergency autoland, G3000 PRIME avionics, improved connectivity, and cost efficiency.

Key Players

- Gulfstream

- Bombardier

- Dassault

- Textron Aviation

- Wheels Up

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302