IMARC Group has recently released a new research study titled “Mexico Pharmaceuticals Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

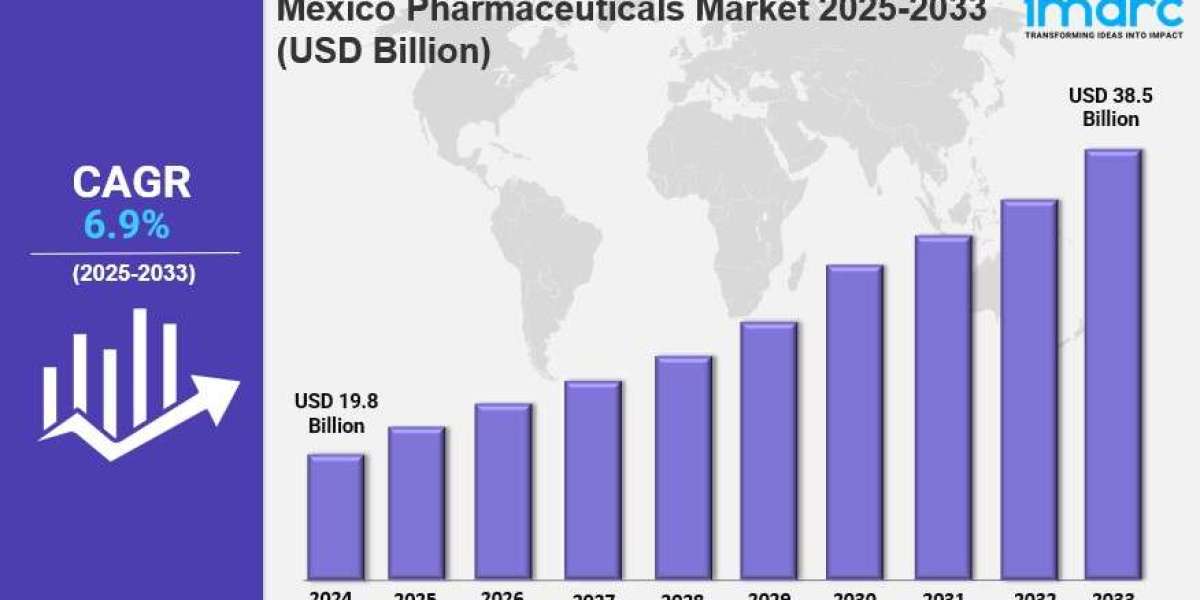

The Mexico pharmaceuticals market size reached USD 19.8 Billion in 2024 and is expected to reach USD 38.5 Billion by 2033, with a compound annual growth rate (CAGR) of 6.9% during the forecast period of 2025-2033. The growth is driven by factors such as an aging population, the rising prevalence of chronic diseases, government initiatives to upgrade healthcare infrastructure, and increased foreign investments fostered by trade agreements like USMCA enhancing intellectual property protections.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Mexico Pharmaceuticals Market Key Takeaways

- Current Market Size: USD 19.8 Billion in 2024

- CAGR: 6.9% during 2025-2033

- Forecast Period: 2025-2033

- Mexico is investing in the expansion and modernization of healthcare infrastructure, including new clinics, hospitals, and research facilities, enhancing capacity for medical services.

- An aging population with an increasing prevalence of chronic diseases like hypertension, diabetes, and cardiovascular conditions is fueling demand for pharmaceutical products.

- Government initiatives and foreign investments stimulated by trade agreements such as USMCA support market growth.

- Distribution channels include hospital pharmacy, retail pharmacy, and online pharmacy, catering to diverse patient needs across regions.

- Regional coverage includes Northern Mexico, Central Mexico, Southern Mexico, and others, supporting market segmentation.

Sample Request Link: https://www.imarcgroup.com/mexico-pharmaceuticals-market/requestsample

Market Growth Factors

The Mexico pharmaceutical market demand is also driven by continuing rapid investment in certain healthcare infrastructure, with increasing hospital, clinic, laboratory, research center construction, renovation, and the modernizing of healthcare machinery and technology. These improvements have increased access to pharmaceuticals and other medical services in all parts of the country. A public platform launched by the Ministry of Health in April 2025 gives citizens access to information about availability, price and providers of medication to improve market dynamics and accountability.

Mexico's demographics are shifting. The demand for pharmaceuticals is expected to increase as an aging population becomes afflicted with an increased risk of chronic diseases such as hypertension, diabetes, and cardiovascular disease. The trend is attributed to the increased use of chronic disease medications and specialty medications, leading to higher utilization rates of both generic and brand-name drugs. In March 2025, Eli Lilly announced that it would expand diabetes and weight-loss medications in Mexico to help with the country's obesity rates.

Trade agreements such as USMCA have become a major driver of FDI in Mexico's pharmaceutical industry by strengthening and extending IP and data exclusivity provisions. These provisions increase the incentives for international pharmaceutical companies to enter the Mexican market, which drives technology transfer, innovation, and capital inflows. These factors, in conjunction with FDI, are expected to drive market growth through 2033.

To get more information on this market: Request Sample

Market Segmentation

Breakup by Product Type:

- Prescription drugs

- Branded Drugs: Includes branded prescription pharmaceutical products.

- Generic Drugs: Covers generic alternatives to branded drugs.

- Over the counter (OTC) drugs: Non-prescription drugs available for consumer use.

Breakup by Application:

- Cardiovascular Diseases: Pharmaceuticals for heart and blood vessel-related ailments.

- Diabetes: Drugs targeting blood sugar regulation and diabetes management.

- Cancer: Medicines used in oncology treatments.

- Obesity: Pharmaceutical treatments addressing obesity.

- Infectious Diseases: Drugs for combating infectious conditions.

- Others: Additional unspecified medical applications.

Breakup by Distribution Channel:

- Hospital Pharmacy: Distribution through hospital-based pharmacies.

- Retail Pharmacy: Pharmacies serving retail customers.

- Online Pharmacy: Digital platforms for pharmaceutical sales.

Regional Insights

The report analyzes prominent regions including Northern Mexico, Central Mexico, Southern Mexico, and others. While specific market share or CAGR by region is not provided, the segmentation supports understanding regional dynamics and distribution. This granular regional breakdown facilitates targeted market strategies adjusting for local needs and healthcare infrastructure across Mexico.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=32946&flag=C

Recent Developments & News

In March 2025, Knight Therapeutics Inc., a specialty pharmaceutical firm operating across the Americas (excluding the US), introduced Minjuvi® (tafasitamab) through its Mexican branch Grupo Biotoscana de Especialidad S.A. de C.V. Minjuvi® is approved for adult patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) unsuitable for autologous stem cell transplantation. In April 2025, Hanmi Pharmaceutical launched Gugutams in Mexico under the brand name "Aditams," a combination treatment for Obstructive Prostatic Growth (OPG) related to Benign Prostatic Hyperplasia (BPH) and Erectile Dysfunction (ED).

Key Players

- Eli Lilly

- Novo Nordisk

- Knight Therapeutics Inc.

- Grupo Biotoscana de Especialidad S.A. de C.V.

- Hanmi Pharmaceutical

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302