IMARC Group has recently released a new research study titled “United States Drug Screening Market Size, Share, Trends and Forecast by Product and Service, Sample Type, End User, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

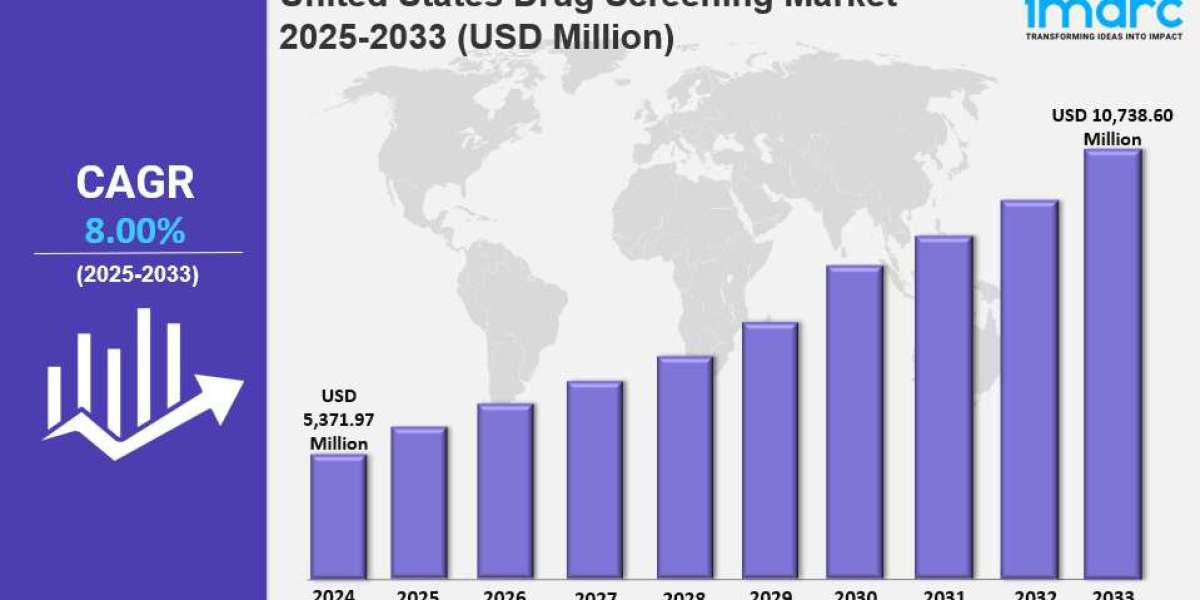

The United States drug screening market share was valued at USD 5,371.97 Million in 2024 and is projected to reach USD 10,738.60 Million by 2033. The market is expected to grow at a CAGR of 8.00% during the forecast period from 2025 to 2033. Growth is driven by factors such as increased workplace testing, rising substance abuse rates, advancements in testing technology, legalization of marijuana, public safety concerns, expanding rehabilitation programs, and supportive government regulations.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

United States Drug Screening Market Key Takeaways

- Current Market Size: USD 5,371.97 Million in 2024

- CAGR: 8.00%

- Forecast Period: 2025-2033

- Approximately 56% of U.S. employers conducted drug testing in 2023, marking an increase reflecting greater workplace safety focus.

- Workplace drug testing is mandatory in many industries including transportation, construction, and healthcare to comply with federal and state regulations.

- Legalization of marijuana increased positivity rates among the workforce by 10.3% in 2023, prompting demand for precise THC detection.

- Rapid testing devices hold a 32.0% market share due to convenience and immediate results in roadside and workplace testing.

- Urine testing dominates sample types with a 77.8% market share, valued for non-invasive appeal and detection capabilities.

Sample Request Link: https://www.imarcgroup.com/united-states-drug-screening-market/requestsample

United States Drug Screening Market Growth Factors

Workplace drug testing has become increasingly common as employers emphasize safety and productivity. In 2023, about 56% of U.S. employers conducted drug testing on employees, including pre-employment and ongoing screening. Industries such as transportation, construction, and healthcare enforce mandatory drug testing, complying with DOT and other federal regulations. Employers also invest in random testing to discourage substance abuse, which steadily increases demand for reliable drug screening solutions, driving market growth.

Rising substance abuse remains a critical factor fueling demand for drug testing. The National Institute on Drug Abuse reports over 20 million Americans affected by substance use disorders. The opioid crisis and state-level marijuana legalization have intensified the need for drug tests in healthcare, legal, and community contexts. Quick, accurate detection solutions are sought to address addiction-related challenges, expanding market opportunities.

Technological advancements enhance drug testing's speed, accuracy, and convenience. Innovative instant drug test kits and portable devices enable on-the-spot screening by employers and law enforcement. Advanced laboratory methods, including hair follicle and oral fluid tests, provide longer detection windows or immediate results, improving reliability and reducing costs. These innovations broaden accessibility and applicability across sectors, supporting market expansion.

To get more information on this market, Request Sample

United States Drug Screening Market Segmentation

Breakup by Product and Service:

- Equipment

- Rapid Testing Devices

- Consumables

- Laboratory Services

Rapid testing devices, including portable urine, saliva, and breath analyzers, hold a 32.0% market share owing to their convenience and immediate results, commonly used in workplaces, roadside checks, and emergency healthcare.

Breakup by Sample Type:

- Urine Samples

- Breath Samples

- Oral Fluid Samples

- Hair Samples

- Others

Urine samples hold a dominant 77.8% market share due to their non-invasive nature, low cost, and broad detection capabilities, widely utilized in workplaces, healthcare, and government programs.

Breakup by End User:

- Hospitals

- Drug Testing Laboratories

- Workplaces

- Drug Treatment Centers

- Pain Management Centers

- Personal Users

- Criminal Justice System and Law Enforcement Agencies

Workplaces constitute the largest end-user segment with a 33.6% market share, driven by pre-employment, random, and post-incident testing to ensure safety and compliance, especially in transportation, construction, and healthcare sectors.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20114&flag=C

Regional Insights

The South region dominates the United States drug screening market with a 32.2% share, attributable to its large population density and extensive workforce. Work-related and pre-employment drug testing practices are prevalent, supported by booming industries in construction, logistics, and healthcare. Additionally, numerous drug treatment centers address addiction rates, further fueling the market in this region.

Recent Developments & News

- In January 2025, Northlane Capital Partners (NCP) invested in United States Drug Testing Laboratories Inc. (USDTL), a forensic toxicology lab specializing in alcohol and substance use testing.

- April 2024 saw Accurate Background launch a new mobile-first drug and health screening platform with clinic scheduling and report generation features.

- In May 2024, eMed partnered with i3screen to offer timely oral drug screening for employers.

- Sterling acquired Vault Workforce Screening in January 2024, enhancing drug and occupational health screening services for regulated industries.

Key Players

- Abbott

- Alfa Scientific Designs Inc.

- Bio-Rad Laboratories Inc.

- Drägerwerk AG & Co. KGaA

- Laboratory Corporation of America Holdings

- Lifeloc Technologies Inc.

- Omega Laboratories Inc.

- OraSure Technologies Inc.

- Psychemedics Corporation

- Quest Diagnostics Incorporated

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302