IMARC Group has recently released a new research study titled “United States Diagnostic Imaging Market Size, Share, Trends and Forecast by Modality, Application, End User, and Region, 2025-2033” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

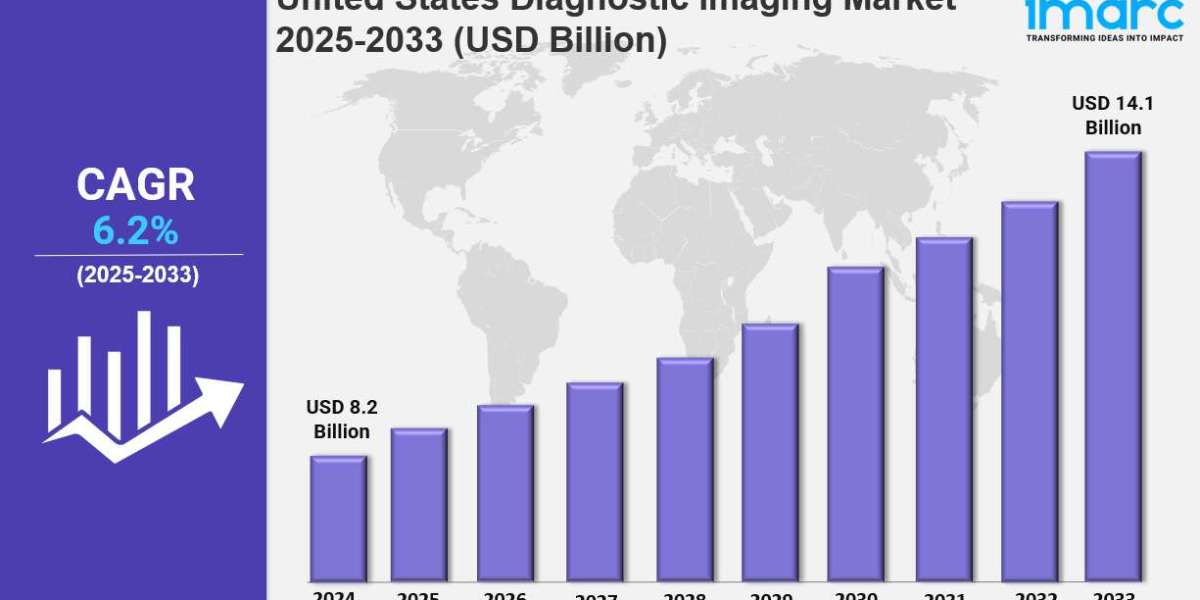

The United States diagnostic imaging market size was valued at USD 8.2 Billion in 2024 and is projected to reach USD 14.1 Billion by 2033. It is expected to grow at a CAGR of 6.2% during the forecast period from 2025 to 2033. This growth is driven by technological advancements, an increasing geriatric population, and rising chronic diseases.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

United States Diagnostic Imaging Market Key Takeaways

- Current Market Size: USD 8.2 Billion in 2024

- CAGR: 6.2% from 2025 to 2033

- Forecast Period: 2025-2033

- The market growth is fueled by technological advancements in MRI, CT, and ultrasound imaging.

- The expanding geriatric population, projected to reach 82 million by 2050, creates demand for imaging related to age-associated conditions.

- Increasing prevalence of chronic diseases, with around 129 million Americans affected, boosts the need for diagnostic imaging.

- Hospitals hold a major share of the market due to comprehensive diagnostic services.

- Diagnostic centers are rapidly growing, offering convenient, outpatient imaging services.

- A favorable reimbursement policy and government support stimulate market expansion.

Sample Request Link: https://www.imarcgroup.com/united-states-diagnostic-imaging-market/requestsample

To get more information on this market, Request Sample

United States Diagnostic Imaging Market Growth Factors

The United States diagnostic imaging market is propelled by rapid technological advancements. Innovations in imaging technologies such as MRI, CT, and ultrasound enhance diagnostic accuracy and patient safety. High-resolution equipment enables early disease detection and better treatment planning. Artificial intelligence integration automates image analysis, reducing human errors. Hybrid imaging systems combining functional and anatomical data are increasingly prevalent. The development of portable and miniaturized devices extends imaging accessibility beyond hospitals, resulting in improved healthcare delivery and patient care advancements.

A significant driver of the market is the increasing geriatric population in the U.S. The report highlights that the number of Americans aged 65 and older is expected to grow to 82 million by 2050, a 47% rise, with their share of the total population increasing from 17% to 23%. Older adults are more susceptible to chronic conditions such as arthritis, osteoporosis, and cardiovascular diseases, which require frequent imaging for diagnosis and management. Additionally, in 2023, about 24.3% of adults aged 65+ reported fair or poor health, with hypertension rates reaching as high as 83.2% in men and 84.1% in women aged 75 and above, further driving imaging demand.

The rising prevalence of chronic diseases is another pivotal growth factor. Around 129 million people in the U.S. suffer from at least one major chronic disease, and about 42% of these individuals have two or more. Key conditions such as cancer, diabetes, and heart diseases rely heavily on detailed and ongoing diagnostic imaging using technologies like CT, MRI, and nuclear medicine. Early disease detection via advanced imaging improves survival rates through targeted treatment strategies. This evolving disease burden encourages healthcare providers to continually upgrade their imaging infrastructure and expand diagnostic service offerings.

Market Segmentation

Breakup by Modality:

- MRI

- Computed Tomography

- Ultrasound

- X-Ray

- Nuclear Imaging

- Others

MRI is highly valued for its detailed soft tissue imaging, including brain, spinal cord, joints, and inner organs. CT imaging delivers detailed cross-sectional images essential for trauma, cancer, and cardiovascular diagnosis, crucial in emergency medicine. Ultrasound is widely used due to its versatility and non-invasiveness, popular in obstetrics, cardiology, and abdominal exams, with accessibility extending to outpatient and home care. X-ray imaging is common for bone fractures, chest, and dental diagnosis with digital radiography enhancing image quality and reducing radiation. Nuclear imaging detects early disease signs in organs through PET and SPECT, advanced by radiopharmaceuticals and hybrid systems.

Breakup by Application:

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

Cardiology employs imaging such as echocardiography, cardiac MRI, and CT angiography for heart structure and function assessment, including advanced 3D echocardiography and cardiac PET for early disease diagnosis. Oncology relies on PET, CT, and MRI for tumor detection, staging, and treatment monitoring. Neurology uses MRI for detailed imaging of brain disorders like multiple sclerosis and stroke. Orthopedic imaging diagnoses musculoskeletal conditions; initial X-rays are followed by MRI or CT for soft tissue or bone structure issues. Gastroenterology utilizes ultrasound, CT, MRI, and endoscopic ultrasound for liver, pancreas, and bowel diseases. Gynecology benefits from advancements in 3D and 4D ultrasound for fetal assessments and early abnormality detection.

Breakup by End User:

- Hospitals

- Diagnostic Centers

- Others

Hospitals dominate the market by providing comprehensive services with advanced MRI, CT, and PET scanners. Diagnostic centers are rapidly growing outpatient facilities focusing on speed, cost-effectiveness, and convenience. They expand access to advanced imaging technologies such as digital X-ray, ultrasound, MRI, and CT scans beyond hospital settings.

Breakup by Region:

- Northeast

- Midwest

- South

- West

Regional Insights

The Northeast U.S. is a dominant region in the diagnostic imaging market with numerous advanced medical facilities and academic hospitals. The aging population and dense resident base drive demand for cardiology and oncology imaging services. The Midwest benefits from community hospitals and specialty centers pushing advanced imaging adoption. The South experiences growth from its expanding population with chronic diseases like heart disease and diabetes, especially in metropolitan areas. The West is a tech-forward region, with demand for AI-integrated imaging and portable devices contributing to market expansion.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=20446&flag=C

Recent Developments & News

In May 2024, United Imaging received FDA clearance for its uMR Jupiter 5T MRI system, the first ultra-high field system cleared for whole-body applications. In November 2024, Royal Philips obtained FDA 510(k) clearance for its detector-based Spectral CT 7500 RT, a radiotherapy solution within spectral CT, enhancing computed tomography capabilities.

Key Players

- United Imaging

- Royal Philips

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302