IMARC Group has recently released a new research study titled “United States Online Grocery Market Size, Share, Trends and Forecast by Product Type, Business Model, Platform, Purchase Type, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

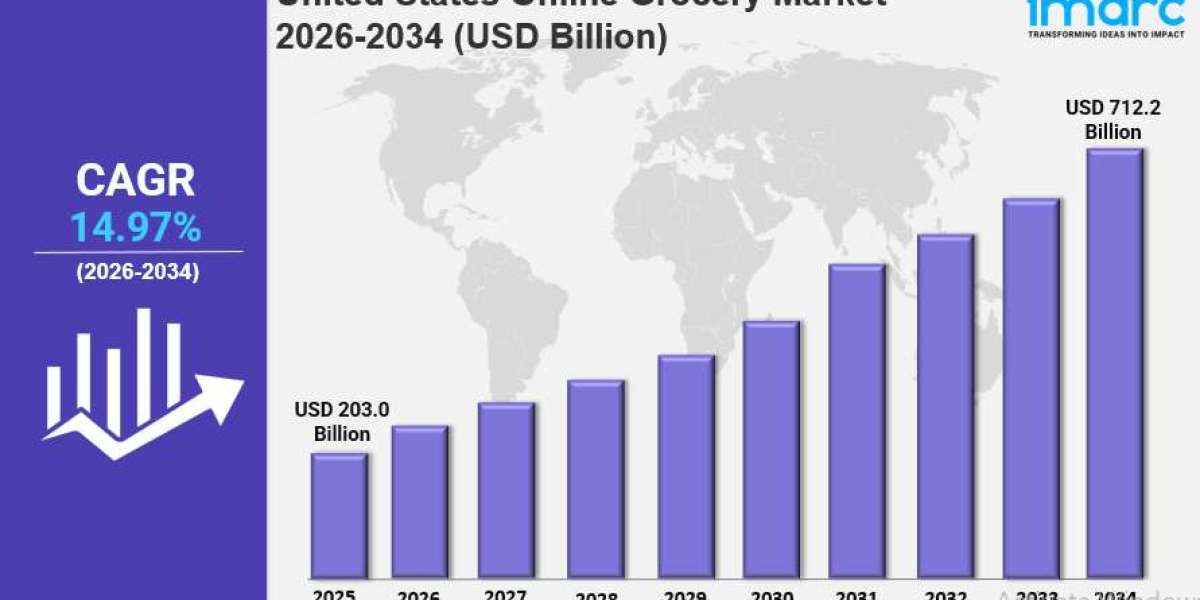

The United States online grocery market size was valued at USD 203.0 Billion in 2025 and is projected to reach USD 712.2 Billion by 2034, growing at a CAGR of 14.97% during the forecast period 2026-2034. Growth is driven by rising demand for convenient shopping, expansion of rapid delivery services, increasing adoption of mobile apps and digital payments, subscription-based delivery services, and integration of AI and personalized recommendations.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

United States Online Grocery Market Key Takeaways

- Current Market Size: USD 203.0 Billion in 2025

- CAGR: 14.97%

- Forecast Period: 2026-2034

- Increasing demand for convenient and time-saving shopping solutions is a key driver.

- Expansion of same-day and express delivery services by major retailers enhances market reach.

- Mobile payment features, contactless transactions, and personalized promotions increase consumer engagement.

- AI-driven subscription models improve online grocery shopping experiences.

- South region holds the largest market share due to its population and infrastructure.

- Retailers are strengthening fulfillment networks and strategic alliances to meet demand.

Sample Request Link: https://www.imarcgroup.com/united-states-online-grocery-market/requestsample

United States Online Grocery Market Growth Factors

United States online grocery market growth is being driven by shifting consumer preferences toward convenience and the widespread adoption of e-commerce. Changing lifestyles, long working hours, and busy urban living have accelerated demand for online grocery shopping. According to the World Bank, 83% of the U.S. population lived in urban areas in 2023, creating ideal conditions for rapid adoption of same-day and express delivery services. These services allow consumers to conveniently access fresh, frozen, and packaged foods within hours, eliminating the need for traditional supermarket visits and fueling continued expansion of the United States online grocery market.

People adopt online grocery market services as mobile payment solutions pay contactlessly and when stores offer personalized customer deals. The mobile payments market in the U.S. is projected to grow at a 22.2% CAGR from 2024 to 2032 and follows a global trend of commerce digitization. AI-based mobile apps and subscription services can simplify ordering, rescheduling deliveries and in notifying consumers of product availability in real-time.

Retailers and delivery service providers are partnering with each other in order to build out their fulfillment networks to meet demand for online grocery shopping and improve supply chain efficiency. The online grocery market increased in size because parties adopted AI-powered inventory management and predictive ordering. Private-label expansion, loyalty programs, and contactless payments are also expected to increase consumer convenience and propel market growth in turn.

To get more information on this market, Request Sample

United States Online Grocery Market Segmentation

Breakup by Product Type:

- Vegetables and Fruits

- Dairy Products

- Staples and Cooking Essentials

- Snacks

- Meat and Seafood

- Others

Staples and cooking essentials lead the market in 2025 due to continuous demand, convenience, and affordability through mass purchasing, subscriptions, and discounts. Consumer reliance on staples is supported by fast delivery, strong inventory management, and personalized recommendations.

Breakup by Business Model:

- Pure Marketplace

- Hybrid Marketplace

- Others

Pure marketplace models dominate with vast product offerings, competitive pricing, and efficient logistics. They connect multiple sellers without holding inventory, ensuring cost efficiency and scalability through third-party fulfillment, subscription discounts, and personalized promotions.

Breakup by Platform:

- Web-Based

- App-Based

App-based platforms hold the largest market share in 2025 due to convenience, user-friendly interfaces, personalized suggestions, order tracking, AI-driven searches, secure payments, loyalty rewards, and integration of same-day and express delivery services.

Breakup by Purchase Type:

- One-Time

- Subscription

Subscription services dominate with convenience, cost savings, customized shopping, regular deliveries, free shipping, AI recommendations, and automated replenishment, enhancing engagement and meeting busy household demands.

Regional Insights

The South region accounts for the largest share of the United States online grocery market in 2025. This is attributed to its rapidly growing metropolitan and suburban populations, substantial investment in fulfillment centers, and robust last-mile logistics. The region benefits from established distribution networks, competitive pricing, and high mobile app adoption driven by tech-savvy consumers and integrated digital payments. Favorable demographics and expanding infrastructures continue to bolster the South's market dominance.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=3309&flag=C

Recent Developments & News

- On 21 November 2024, Instacart introduced a Supplemental Nutrition Access Program (SNAP) qualification screener on its platform, allowing consumers nationwide to anonymously check SNAP benefit eligibility and access government resources.

- On 7 August 2024, California-based Good Eggs was acquired by GrubMarket, enhancing GrubMarket’s e-commerce presence and AI services in Los Angeles and San Francisco.

- On 21 February 2024, Thrive Market became the first online-only grocery business approved by USDA to accept SNAP EBT, improving accessibility to sustainable and healthy groceries.

- On 8 November 2023, New York City’s FreshDirect was acquired by Turkey-based Getir, aiding Getir’s expansion and allowing FreshDirect to leverage advanced technologies and logistics for faster service.

Key Players

- Albertsons Companies Inc.

- Amazon.com Inc.

- Costco Wholesale Corporation

- H-E-B

- Instacart

- Publix

- Target Brands Inc.

- The Kroger Co.

- Walgreen Co.

- Walmart

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302