TL;DR: Visa’s Acquirer Monitoring Program (VAMP) tracks merchants with excessive chargebacks and fraud. Exceeding thresholds triggers penalties, compliance requirements, and potential account termination, making proactive monitoring essential for payment stability.

I’ve spent over a decade working with high-risk merchants who’ve received that dreaded VAMP notification. The panic is real because the consequences are severe. But here’s what most payment processors won’t tell you: getting flagged by Visa’s monitoring program isn’t random bad luck. It’s a predictable outcome of gaps in your chargeback prevention strategy.

Let me walk you through exactly what VAMP is, how it works, and most importantly, how to stay off Visa’s radar completely.

AI Overview: Understanding VAMP

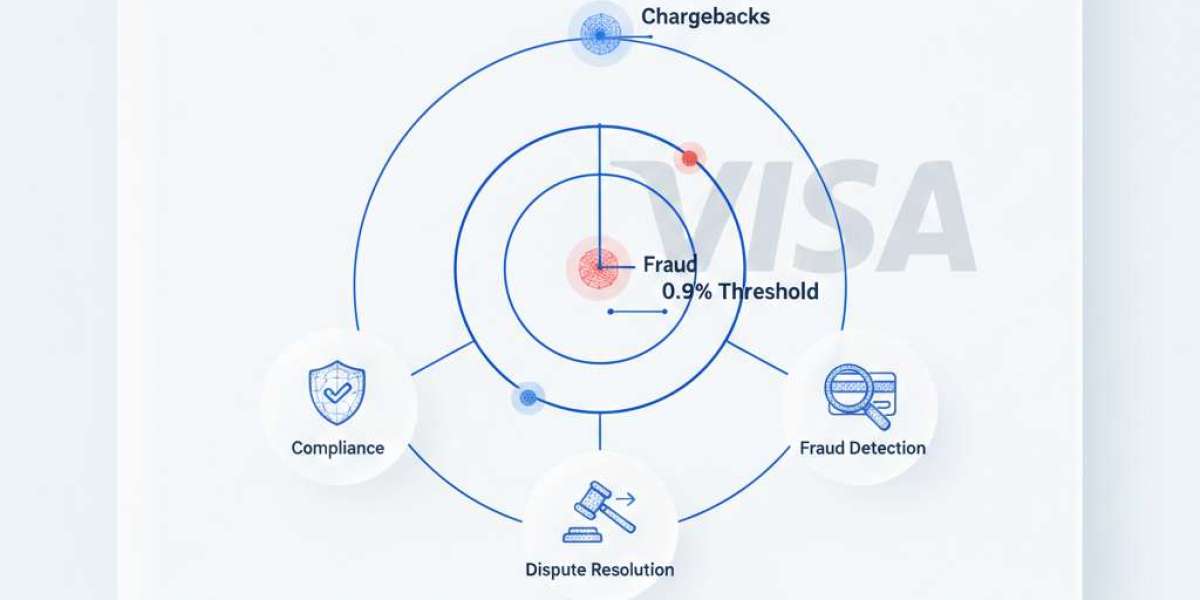

The Visa Acquirer Monitoring Program monitors merchant chargeback and fraud ratios. Merchants with monthly chargebacks exceeding 0.9% face enrollment, escalating fees, and mandatory compliance plans. Prevention requires real-time dispute tracking and robust fraud detection and prevention controls.

What Is the Visa Acquirer Monitoring Program (VAMP)?

The Visa Acquirer Monitoring Program, often called Visa VAMP or the Visa chargeback monitoring program, is Visa’s enforcement mechanism for merchants with elevated dispute rates. It’s part of a broader risk management framework that includes the Visa Fraud Monitoring Program (VFMP).

VAMP doesn’t just track your disputes. It measures your chargeback-to-transaction ratio and fraud-to-sales ratio monthly. When you cross specific thresholds, Visa places you in one of two programs:

- Visa Acquirer Monitoring Program (VAMP): For excessive chargebacks

- Visa Fraud Monitoring Program (VFMP): For excessive fraud disputes (Reason Code 10.4)

Both programs share similar enforcement structures, but VAMP focuses on overall dispute activity while VFMP zeroes in on fraud-specific issues.

How Does the Visa VAMP Program Work?

Here’s where it gets technical, but this is critical to understand.

Visa calculates your chargeback ratio using this formula:

Chargeback Count ÷ Total Transaction Count = Chargeback Ratio

You’re enrolled in VAMP when you hit:

- 0.9% chargeback ratio (90 chargebacks per 10,000 transactions)

- AND at least 100 chargebacks in a single month

Once enrolled, you move through escalating tiers:

VAMP Tier Chargeback Ratio Monthly Fees Requirements Early Warning 0.65% — 0.89% $0 Monitoring only Standard 0.9% — 1.79% $50/month Remediation plan required Excessive 1.8%+ $25,000/month Compliance review, potential termination

The Visa dispute monitoring program doesn’t just levy fines. It forces your acquiring bank to implement corrective action plans. If you don’t reduce your ratios within defined timeframes, Visa can mandate account termination.

Why Do Merchants Get Flagged by VAMP?

I’ve reviewed hundreds of VAMP cases. The patterns are consistent:

1. Unclear Billing Descriptors Customers don’t recognize the charge and dispute it immediately. This is especially common with subscription businesses using parent company names instead of brand names.

2. Poor Customer Service Response Times When customers can’t reach you easily, they go straight to their bank. A chargeback is faster than waiting three days for an email response.

3. Subscription Billing Without Explicit Consent Free trials converting to paid subscriptions without clear notification are chargeback magnets. Visa scrutinizes these transactions heavily.

4. Delayed or Missing Refunds Customers who request refunds but don’t receive them within 5–7 days often file disputes instead of following up.

5. Product Delivery Issues Shipping delays, lost packages, or damaged goods, especially without proactive communication, trigger “product not received” or “not as described” disputes.

What Happens When You’re Enrolled in the Visa VAMP Program?

Let’s be direct: VAMP enrollment is expensive and operationally disruptive.

Immediate Consequences:

- Monthly compliance fees starting at $50, escalating to $25,000+

- Mandatory dispute reduction plans submitted to your acquirer

- Enhanced transaction monitoring and reporting requirements

- Increased processing reserves. Your acquirer may hold 10–20% of revenue

- Reputational damage with payment processors and underwriters

Long-Term Risks:

- Difficulty securing new merchant accounts

- Higher processing rates with risk-based pricing

- Potential placement on the MATCH list (Member Alert to Control High-Risk Merchants)

- Complete loss of Visa processing capabilities

According to Payments Journal, “Merchants enrolled in VAMP for more than 12 consecutive months face a 73% likelihood of account termination” (Payments Journal — Payment Compliance Insights).

How Is VAMP Different from the Visa Fraud Monitoring Program?

This confuses a lot of merchants, so let me clarify:

Program Focus Trigger Threshold Primary Reason Codes VAMP Overall chargebacks 0.9% chargeback ratio All reason codes (fraud, authorization, processing errors) VFMP Fraud-specific disputes 0.9% fraud ratio Reason Code 10.4 (Fraud — Card Absent Environment)

You can be enrolled in both programs simultaneously if you have high overall chargebacks and high fraud-specific disputes. The fees stack.

The key difference: VFMP requires evidence of fraud prevention tools like 3D Secure, AVS matching, and CVV verification. VAMP focuses more broadly on operational improvements across fulfillment, customer service, and billing practices.

How Do You Stay Out of the Visa Acquirer Monitoring Program?

Prevention is exponentially cheaper than remediation. Here’s what actually works:

1. Monitor Your Ratios Weekly Don’t wait for your processor’s monthly report. Track your chargeback rate in real-time. If you’re trending toward 0.65%, you have maybe 2–3 weeks to course-correct before hitting VAMP thresholds. Implementing gateway compliance monitoring helps you track these metrics automatically.

2. Implement Proactive Dispute Alerts Services like Ethoca and Verifi alert you to disputes before they become chargebacks. You can issue immediate refunds and prevent the chargeback from counting against your ratio. I’ve seen this single strategy reduce chargeback rates by 40–60%.

3. Optimize Your Billing Descriptor Your descriptor should immediately identify your brand. Test it: Would your customer recognize “XYZ CORP PMT” on their statement? Probably not. Use “[BRAND] [PRODUCT/SERVICE]” format.

4. Front-Load Customer Communication Email confirmations, shipping updates, and pre-renewal notices drastically reduce disputes. For subscriptions, send reminders 7 days before renewal with one-click cancellation options.

5. Make Refunds Faster Than Chargebacks Your refund policy should beat the chargeback timeline. If customers know they’ll get a refund within 24–48 hours, they won’t dispute. Understanding how to recover failed payments can also reduce unnecessary disputes from legitimate transaction failures.

6. Use Order Insight and Consumer Clarity These Visa and Mastercard tools provide cardholders with detailed transaction information at dispute initiation. Customers who see their order details often withdraw disputes before they’re filed.

What Should You Do If You’re Already in VAMP?

First, don’t panic. Second, act immediately.

Step 1: Request a Detailed Ratio Breakdown Get granular data from your processor: Which product lines, transaction types, or customer segments are driving disputes? A thorough profitability analysis can reveal which products or channels are creating the most risk.

Step 2: Submit a Comprehensive Remediation Plan Visa requires documented corrective actions. This isn’t a formality. Your processor will enforce it. Include:

- Specific chargeback reduction targets (with timelines)

- Operational changes (customer service hours, refund processing times)

- Technology implementations (fraud tools, alert services)

- Staff training protocols

Step 3: Prioritize Quick Wins Fix billing descriptors within 48 hours. Implement dispute alerts within a week. These create immediate ratio improvements. Additionally, optimizing your payment retry strategies can reduce failed transactions that later turn into disputes.

Step 4: Engage a Chargeback Management Specialist If you’re in Excessive tier or approaching 12 months in VAMP, you need expert help. The cost of a consultant is a fraction of VAMP fees and potential account loss.

How Does Payment Infrastructure Impact VAMP Risk?

Many merchants don’t realize that their payment infrastructure directly influences chargeback rates. When payments fail due to technical issues, routing problems, or processing errors, customers often dispute charges instead of contacting support.

Optimizing payment routing can significantly reduce these technical failures. Smart routing ensures transactions are processed through the most reliable paths, minimizing declines that lead to customer frustration and eventual disputes.

Expert Insight

As Visa’s own compliance documentation states, “Acquirers must ensure merchants implement sustainable dispute reduction strategies, not temporary fixes” (Visa Global Risk Compliance).

Conclusion: VAMP Prevention Is Business Protection

The Visa Acquirer Monitoring Program isn’t designed to punish merchants. It’s designed to protect cardholders and maintain payment system integrity. But the financial and operational impact on flagged merchants is severe.

Your chargeback ratio is a real-time health metric for your business operations. If you’re trending toward VAMP thresholds, you have systemic issues in billing, fulfillment, customer service, or fraud prevention that need immediate attention.

The merchants who avoid VAMP entirely are those who treat dispute prevention as a core operational priority, not a reactive afterthought when ratios spike.

Ready to implement a comprehensive chargeback prevention strategy before Visa flags your account? Contact our dispute management team for a free ratio analysis and customized prevention roadmap.

Frequently Asked Questions

What is the Visa VAMP program threshold? VAMP enrollment occurs at 0.9% chargeback ratio with a minimum of 100 chargebacks monthly. Early warning monitoring begins at 0.65%.

How long does VAMP enrollment last? Minimum 3 consecutive months below thresholds required for removal. Most merchants remain enrolled 6–12 months while implementing corrective measures.

Can you avoid VAMP fees if you’re enrolled? No. Fees are mandatory once enrolled. The only way to eliminate them is dropping below thresholds for the required duration.

Does VAMP affect Mastercard processing? VAMP is Visa-specific, but Mastercard has an equivalent program (Excessive Chargeback Program). High ratios on Visa typically indicate broader issues affecting all card brands.

What happens if you ignore VAMP requirements? Your acquiring bank will terminate your merchant account. You’ll be added to the MATCH list, making it extremely difficult to secure processing with any provider.