IMARC Group has recently released a new research study titled “United States Precision Farming Software Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Precision Farming Software Market Overview

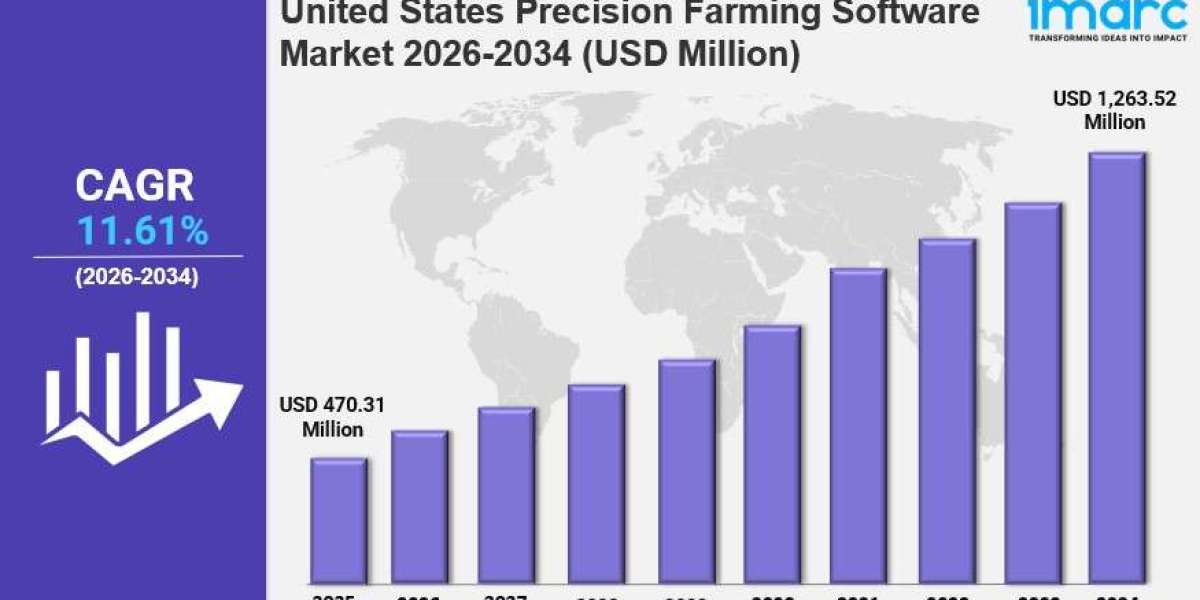

The United States precision farming software market size was valued at USD 470.31 Million in 2025 and is expected to reach USD 1,263.52 Million by 2034. It is projected to grow at a compound annual growth rate (CAGR) of 11.61% during the forecast period from 2026 to 2034. The market growth is driven by rising adoption of cloud-based platforms, AI analytics, and IoT-enabled solutions that enhance farm productivity and sustainability. Government initiatives and technological advances in satellite imagery and drone monitoring further fuel this expansion.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

United States Precision Farming Software Market Key Takeaways

- Market Size in 2025: USD 470.31 Million

- CAGR: 11.61%

- Forecast Period: 2026-2034

- Cloud-based software dominates with 72% market share in 2025 due to scalability and real-time data access.

- Crop management leads applications with 38% market share, focusing on yield optimization and input management.

- Farmers represent the largest end user segment at 69% in 2025, directly adopting precision technologies.

- Government support programs and rising adoption of AI, ML, and IoT technologies are key market growth drivers.

- Challenges include high initial technology investments, connectivity limitations in rural areas, and concerns over data security.

Sample Request Link: https://www.imarcgroup.com/united-states-precision-farming-software-market/requestsample

United States Precision Farming Software Market Growth Factors

The United States precision farming software market growth is chiefly propelled by the surging adoption of data-driven farming practices. The agriculture sector is transitioning from traditional decision-making to utilizing digital platforms that integrate soil sensors, weather stations, GPS-enabled equipment, and satellite imagery. These technologies optimize planting schedules, irrigation, fertilizer application, and pest management with enhanced accuracy, improving yield consistency and reducing input waste. As farm sizes increase, managing dispersed fields manually becomes impractical, underscoring the necessity of software solutions that offer real-time monitoring and historical trend analysis.

Rising crop disease risks and climate variability are further invigorating market expansion. Climate uncertainty and unpredictable weather amplify incidences of pest outbreaks and plant diseases. In 2024, total damages from weather and fire events exceeded USD 20.3 Billion in the U.S., constituting 11.1% of NOAA's disaster economic impact. Precision software facilitates tracking micro-climate and soil moisture in real time, enabling early disease stress detection and proactive interventions. Targeted pesticide application via software support reduces chemical overuse and protects yields, positioning climate resilience as a pivotal long-term market growth factor.

Integration with advanced farm equipment and digital ecosystems significantly contributes to market development. Modern agricultural machinery increasingly incorporates IoT sensors and telematics that depend on software platforms for functionalities like automated steering and real-time diagnostics. Precision farming software hubs consolidate equipment data with agronomic insights, enhancing operational planning. Compatibility with cloud services and broad farm management systems promotes data sharing across the value chain, improving efficiency and supporting sustained software adoption.

To get more information on this market: Request Sample

United States Precision Farming Software Market Segmentation

Breakup by Type:

- Cloud-Based: Dominates with 72% market share in 2025, attributed to scalability, flexibility, remote monitoring, and real-time decision-making. Offers seamless integration with IoT sensors, drones, and GPS-enabled machinery with lower upfront costs and continuous updates.

- Web-Based

Breakup by Applications:

- Crop Management: Leads with 38% market share, focusing on yield optimization, input management, and growth monitoring. Integrates satellite imagery, drone surveys, and sensors for comprehensive visibility. Essential for both large commercial and mid-sized farms.

- Financial Management

- Farm Inventory Management

- Personnel Management

- Weather Tracking and Forecasting

- Others

Breakup by End Users:

- Farmers: Largest segment with 69% share in 2025, directly adopting precision technologies to manage inputs, monitor conditions, and improve cost efficiency. Encouraged by increased digital literacy and accessible connected equipment.

- Agricultural Cooperatives

- Research Institutions

Breakup by Regions:

- Northeast: Driven by diversified crops, smaller farms, high technology adoption, and sustainability focus.

- Midwest: Prominent due to large-scale row crop farming, strong equipment integration, and yield optimization.

- South: Strong growth from diverse crops, longer seasons, and mechanization, focusing on irrigation and pest management.

- West: Growth fueled by high-value crops, water scarcity, advanced irrigation, and technology-focused farming.

Regional Insights

The Midwest region holds prominence in the United States precision farming software market due to extensive corn and soybean cultivation and high technology adoption. Strong equipment integration and emphasis on yield optimization make precision software essential for large commercial farms across this region.

Recent Developments & News

In June 2024, Sentera, based in Minnesota, launched an Early Access Program using AI-powered drone technology for weed identification and herbicide application recommendations. This program covered over 10,000 acres across Illinois, Iowa, Minnesota, North Dakota, and South Dakota and aims to reduce herbicide usage by up to 70% through targeted spot-spray applications.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=24616&flag=C

In August 2025, the Association of Equipment Manufacturers (AEM), along with the American Farm Bureau Federation, American Soybean Association, CropLife America, and National Corn Growers Association, released an updated study highlighting benefits of precision agriculture, including a 5% yearly crop yield increase with potential for an additional 6% rise through increased adoption.

Key Players

- AEM

- American Farm Bureau Federation

- American Soybean Association

- CropLife America

- National Corn Growers Association

- Sentera

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302