IMARC Group has recently released a new research study titled “United States Blockchain in BFSI Market Report by Type (Private, Public, Consortium, Hybrid), Component (Platform, Services),Application (Digital Currency, Record Keeping, Payments and Settlement, Smart Contracts, Compliance Management, and Others), End User (Banking, Insurance, Non-Banking Financial Companies (NBFCs)), and Region 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

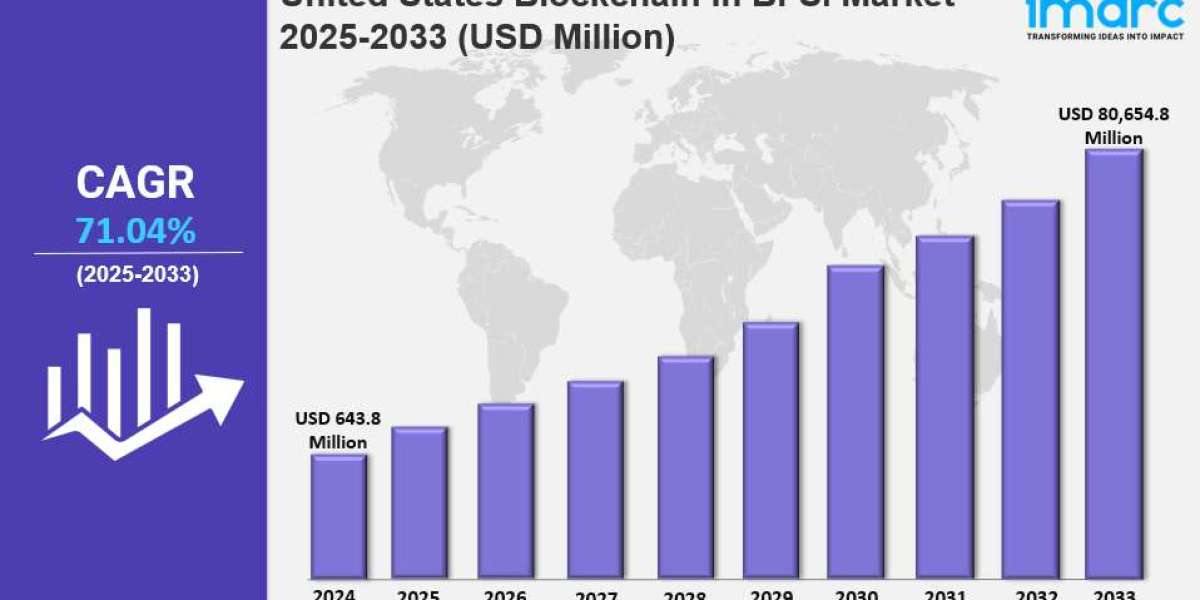

The United States blockchain in BFSI market size was USD 643.8 Million in 2024. It is projected to reach USD 80,654.8 Million by 2033, growing at a CAGR of 71.04% during the forecast period of 2025-2033. The market growth is driven by rising security breaches and fraud in BFSI, proliferation of blockchain platforms, and increased partnerships between BFSI institutions and technology firms.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

United States Blockchain in BFSI Market Key Takeaways

- Market Size in 2024: USD 643.8 Million

- CAGR (2025-2033): 71.04%

- Forecast Period: 2025-2033

- Increasing security breaches and fraud cases in BFSI are major growth drivers.

- Proliferation of various blockchain networks and platforms is pushing demand.

- Rising collaborations between BFSI institutions and tech companies accelerate adoption.

- Tokenization of securities enhances trading, liquidity, and fractional ownership.

- Use of blockchain in supply chain finance increases transparency and efficiency.

Sample Request Link: https://www.imarcgroup.com/united-states-blockchain-in-bfsi-market/requestsample

United States Blockchain in BFSI Market Growth Factors

The United States blockchain in BFSI market is primarily propelled by the increasing number of security breaches and fraud incidents within the BFSI sector. These challenges encourage financial institutions to adopt blockchain technology, known for its cryptographic techniques and decentralized architecture that provide robust defense against cyberattacks. Such security features support transparency, trust, and immutability of data, which are vital for protecting sensitive financial information.

Moreover, the proliferation of diverse blockchain networks and platforms is driving the need for interoperable solutions. Companies in the US are developing blockchain protocols that enable seamless communication and transactions across numerous blockchain ecosystems, thus enhancing flexibility and accessibility. The integration of privacy-enhancing technologies like zero-knowledge proofs protects sensitive financial data while maintaining transparency, broadening customer acceptance of blockchain-based solutions.

Additionally, the growing partnerships between BFSI institutions and technology companies facilitate the joint development and implementation of blockchain solutions tailored to industry challenges. Investments in blockchain startups and participation in the digital asset ecosystem fuel market expansion. The rising tokenization of traditional securities such as stocks and bonds on blockchain platforms introduces easier trading, fractional ownership, and increased liquidity. Furthermore, blockchain's application in supply chain finance promotes greater transparency and efficiency by enabling real-time tracking of goods and payments.

To get more information on this market, Request Sample

United States Blockchain in BFSI Market Segmentation

Breakup By Type:

- Private

- Public

- Consortium

- Hybrid

These segments represent different blockchain deployment models characterized by varying levels of access and governance.

Breakup By Component:

- Platform: Encompasses blockchain platforms facilitating network operations and transactions.

- Services: Includes services supporting implementation, maintenance, and consulting.

Breakup By Application:

- Digital Currency: Use of blockchain for cryptocurrencies and digital monetary units.

- Record Keeping: Blockchain-enabled maintaining of transparent and immutable transaction records.

- Payments and Settlement: Processing payments and settlements via blockchain.

- Smart Contracts: Automated contract execution through blockchain code.

- Compliance Management: Managing regulatory compliance via blockchain solutions.

- Others

Breakup By End User:

- Banking: Financial institutions adopting blockchain for diverse banking functions.

- Insurance: Insurers utilizing blockchain for claims and fraud reduction.

- Non-Banking Financial Companies (NBFCs): Financial entities outside traditional banks using blockchain technology.

Regional Insights

The report highlights comprehensive analysis across major U.S. regions including Northeast, Midwest, South, and West. However, the source does not specify the dominant region or exact statistics such as market share or CAGR by region.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=20142&flag=C

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302