IMARC Group has recently released a new research study titled “Mexico Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Sales Channel, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

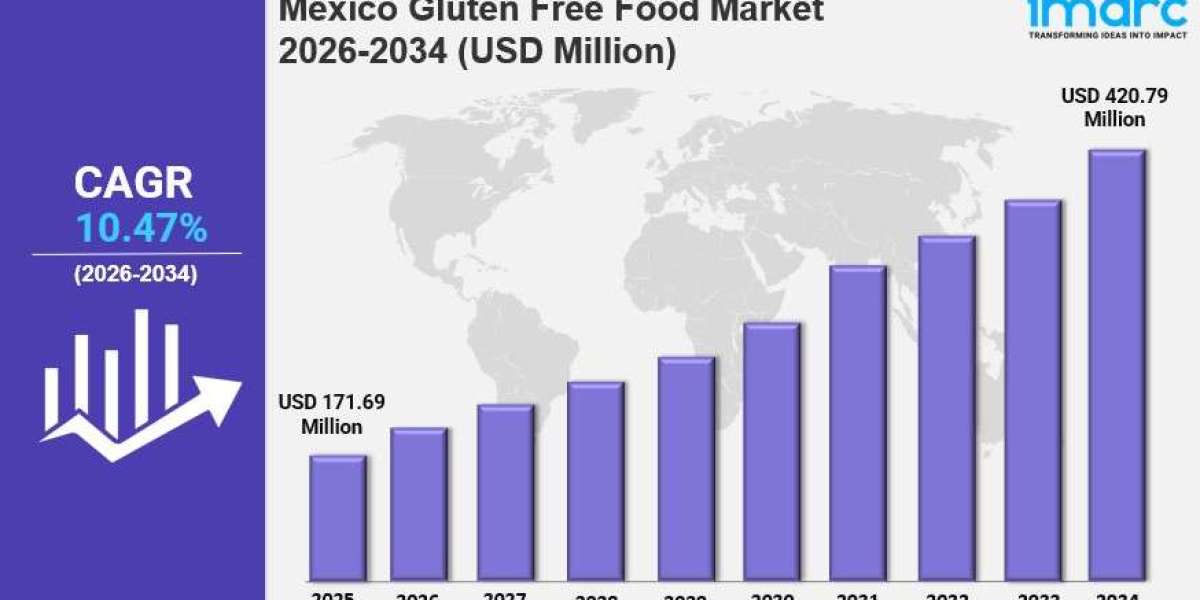

The Mexico gluten free food market size was valued at USD 171.69 Million in 2025 and is forecasted to reach USD 420.79 Million by 2034, growing at a CAGR of 10.47% during 2026-2034. This robust growth is propelled by increasing consumer health awareness, rising gluten-related disorder diagnoses, and the country's rich heritage of naturally gluten-free corn-based foods. Growing urbanization, middle-class incomes, and retail expansion further fuel this momentum. Enhanced availability in mainstream supermarkets and dedicated gluten-free bakeries also drive adoption.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Mexico Gluten Free Food Market Key Takeaways

- Current Market Size: USD 171.69 Million in 2025

- CAGR: 10.47% (2026-2034)

- Forecast Period: 2026-2034

- Bakery and Confectionery dominate with a 35% market share in 2025, fueled by demand for gluten-free bread, tortillas, and baked goods resembling traditional wheat products.

- Plant-Based sources hold the largest market share of 72% in 2025, led by corn, rice, amaranth, quinoa, and other ancient grains aligned with clean-label trends.

- Hypermarkets/Supermarkets represent the largest sales channel with 37% share in 2025, offering extensive product variety, competitive pricing, and convenience.

- The market includes multinational corporations, regional manufacturers, and local brands focusing on product innovation, clean-labels, and distribution partnerships.

- Updated national allergen-labeling regulations in 2024 require clear gluten declaration, enhancing transparency and consumer confidence.

Sample Request Link: https://www.imarcgroup.com/mexico-gluten-free-food-market/requestsample

Market Growth Factors

Medical diagnosis rates and public awareness of gluten-related disorders in Mexico are increasing, which is significantly boosting Mexico gluten free food market demand across retail and foodservice channels. For instance, a 2004-2005 serologic screening found positivity for tTGA antibodies in about 2.7% of healthy blood donors, indicating a potentially larger undetected celiac population. Improved diagnostic tools and provider education have expanded the medically-driven consumer base. Patient advocacy and public health initiatives disseminate information on symptoms, diagnosis, and diet management, facilitating informed consumer choices.

The gluten-free adoption extends beyond medical necessity to wellness trends, particularly among millennials and urban professionals valuing digestive health and weight management. In 2024, 61% of Mexicans reported reducing gluten intake even without diagnosed disorders, signaling dietary shifts towards healthier lifestyles. Social media and wellness trends amplify gluten-free interest as part of clean eating and anti-inflammatory diets, boosting voluntary consumption.

Mexico's retail modernization enlarges gluten-free product availability nationwide. Major supermarket chains increase category shelf space, and specialty health stores proliferate especially in urban areas. The 2024 Ley General de la Alimentación Adecuada y Sostenible proactively supports wider access to specialized diets including gluten-free. Dedicated gluten-free bakeries and restaurants enhance convenience. E-commerce growth further improves access for underserved regions, enhancing overall market accessibility.

To get more information on this market Request Sample

Market Segmentation

Breakup by Product Type:

- Bakery and Confectionery: Dominates with 35% share in 2025, reflecting the importance of bread, pastries, and baked goods in Mexico's diet. Advances in baking technology improve product quality, closely replicating wheat-based items.

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

Breakup by Source:

- Plant-Based: Leads with 72% share in 2025, supported by Mexico's rich agriculture and availability of gluten-free crops like corn, rice, amaranth, quinoa, and legumes. Rising sustainability and health interests boost demand.

- Animal-Based

Breakup by Sales Channel:

- Hypermarkets/Supermarkets: Largest segment with 37% share in 2025, favored for wide product selection, price competitiveness, and convenience. Promotions and loyalty programs enhance consumer engagement.

- Convenience Stores

- Specialty Store

- Pharmacies

- Online Retail

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and others constitute the regional segments. The report does not specify the dominant region or exact market shares. However, retail presence data shows high economic unit concentrations in Estado de México, Ciudad de México, and Puebla, indicating significant market activity in Central Mexico. This suggests a growing demand within these economic hubs supported by extensive retail infrastructure.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=35950&flag=C

Recent Developments & News

In February 2024, the BRCGS Global Standard for Gluten-Free, Issue 4, was released, offering heightened certification standards. This certification received approval across associations in the USA, Canada, and Mexico, allowing certified producers to use recognized trademarks such as the Acelmex gluten-free trademark in Mexico and Latin America. Additionally, Grupo Bimbo SAB de CV acquired Amaritta Food SL in February 2024, a company specializing in gluten-free bread research and production, aiming to leverage new technologies and capitalize on market growth opportunities.

Key Players

- Grupo Bimbo SAB de CV

- Amaritta Food SL

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302