IMARC Group has recently released a new research study titled “Mexico Application Processor Market Size, Share, Trends and Forecast by Device Type, Core Type, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

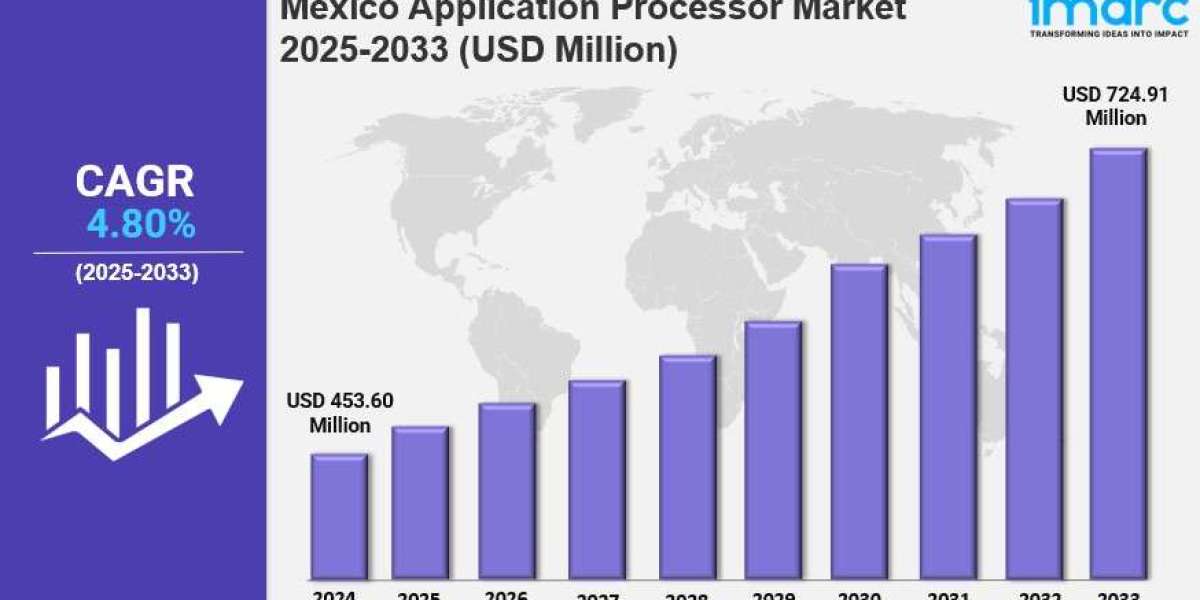

The Mexico application processor market size reached USD 453.60 Million in 2024. Forecasts indicate growth to USD 724.91 Million by 2033, growing at a CAGR of 4.80% during the forecast period of 2025-2033. This growth is driven by accelerating 5G smartphone demand, expanding telecom infrastructure, IoT device adoption, and increasing local semiconductor manufacturing bolstered by government support and strategic partnerships.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Mexico Application Processor Market Key Takeaways

- Current Market Size: USD 453.60 Million in 2024

- CAGR: 4.80% (2025-2033)

- Forecast Period: 2025-2033

- Mexico has reached significant 5G adoption with 6.6 million customers in 2024, representing 51% of total mobile subscriptions.

- Over 70% of Mexican executives plan to adopt 5G technology in 2024 to boost revenues and operational efficiency.

- Telecom operators are rapidly rolling out 5G infrastructure, accelerating demand for advanced application processors.

- Local semiconductor manufacturing is expanding, driven by nearshoring trends and government incentives, reducing import reliance.

- Key manufacturing hubs include Chihuahua and central Mexico, attracting global semiconductor players.

- The market includes processors for mobile phones, PC tablets and e-readers, smart wearables, and automotive ADAS and infotainment devices.

Sample Request Link: https://www.imarcgroup.com/mexico-application-processor-market/requestsample

Market Growth Factors

The Mexico application processor market is primarily propelled by increasing demand for 5G-capable chips amid rapid expansion of 5G networks nationwide. In 2024, Mexico achieved 5G adoption with 6.6 million subscribers, comprising 51% of total mobile subscriptions. Industries including logistics and transportation show strong interest, with over 70% of executives planning 5G adoption to enhance operational efficiency and revenue. Telecom operators are aggressively rolling out 5G infrastructure, compelling smartphone manufacturers to equip devices with advanced processors supporting high-speed connectivity. Mid-range and premium smartphone segments are increasingly incorporating Qualcomm Snapdragon and MediaTek Dimensity processors, responding to this surge in 5G adoption.

Growth is further fueled by the rising popularity of IoT and smart devices in Mexico, creating a need for energy-efficient and high-performance application processors. As the market’s 5G penetration accelerates, partnerships between local OEMs and global chip vendors are expected to intensify. This collaboration aims to improve processor availability and innovation, positioning 5G-capable processors as a critical growth driver for the Mexico application processor market.

Another significant driver is the rising emphasis on local semiconductor manufacturing, backed by government and private sector investments to reduce import dependency while strengthening supply chain resilience. The Mexican electronics manufacturing sector contributes over 2.5% to the country's GDP and employs around 400,000 people, with consumer electronics revenue forecasted to reach USD 17.4 Billion in 2024. Key production hubs include Chihuahua and central Mexico. Global semiconductor firms are establishing collaborations and expanding operations in Mexico to produce application processors for automotive, industrial, and consumer electronics sectors. Nearshoring trends, spurred by US-China trade tensions, motivate tech companies to set up manufacturing bases in Mexico, positively impacting cost-effective processor availability and fostering chip design innovation. Collectively, these factors consolidate Mexico’s growing competitiveness in the regional semiconductor industry.

To get more information on this market Request Sample

Market Segmentation

Device Type Insights:

- Mobile Phones: Application processors used in smartphones, including 5G capable models, driving significant market demand.

- PC Tablets and E-Readers: Processors integrated into portable computing and reading devices for enhanced user performance.

- Smart Wearables: Processors for wearable technology requiring energy efficiency and high processing power.

- Automotive ADAS and Infotainment Devices: Processors used in vehicles for advanced driver-assistance systems and infotainment functionalities.

Core Type Insights:

- Octa-Core: High-performance multi-core processors with eight cores for demanding applications.

- Hexa-Core: Six-core processors balancing power and efficiency.

- Quad-Core: Processors with four cores, commonly used in mid-range devices.

- Dual-Core: Two-core processors for less intensive processing needs.

- Single-Core: Basic processors catering to simple tasks and low-power consumption devices.

Regional Insights

Northern Mexico, Central Mexico, Southern Mexico, and Others are the major regional markets analyzed. The report highlights manufacturing hubs such as Chihuahua in Northern Mexico and central Mexico as key players supporting the market growth. The domestic semiconductor industry’s rise in these regions complements expanding telecom infrastructure, fostering enhanced application processor production and availability across Mexico.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=33876&flag=C

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302