IMARC Group has recently released a new research study titled “United States Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End Use Industry, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

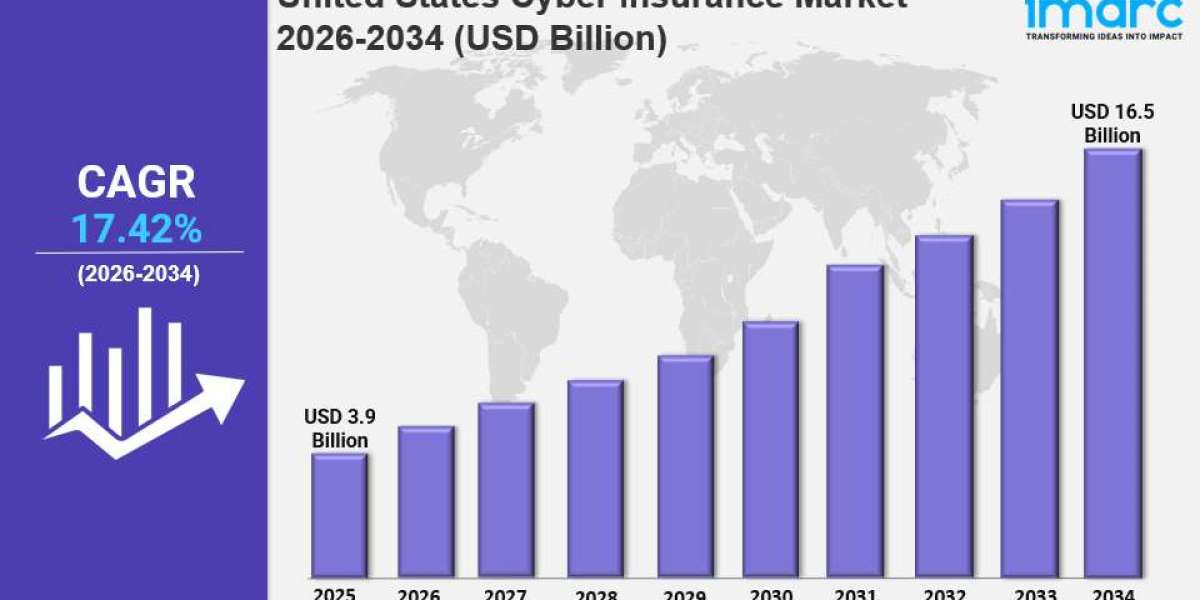

The United States cyber insurance market was valued at USD 3.9 Billion in 2025 and is projected to reach USD 16.5 Billion by 2034, growing at a CAGR of 17.42% during the forecast period of 2026-2034. The market growth is driven by escalating cyber threats, stringent regulations, rapid digital transformation, and increasing awareness of cyber risks. The market also benefits from advancements in insurance products tailored for various industry needs.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

United States Cyber Insurance Market Key Takeaways

- Current Market Size: USD 3.9 Billion in 2025

- CAGR: 17.42% from 2026 to 2034

- Forecast Period: 2026-2034

- Cyberattacks on U.S. utilities increased by nearly 70% in 2024, revealing rising vulnerabilities in critical infrastructure.

- In 2023, ransomware attacks rose by 74% compared to 2022, with average incident costs reaching $4.91 million.

- In 2023, cybersecurity premium rates dropped by 17% on average, reflecting a buyer-friendly market.

- Approximately 62% of U.S. companies filed cyber insurance claims in 2023 and 2024, with over 27% submitting multiple claims.

- The U.S. cyber insurance market is spurred by regulations such as new SEC rules on cybersecurity disclosures introduced in 2023.

Sample Request Link: https://www.imarcgroup.com/united-states-cyber-insurance-market/requestsample

United States Cyber Insurance Market Growth Factors

The U.S. cyber insurance market is primarily propelled by a surge in cyber threats, including ransomware, phishing, and advanced persistent threats (APTs). Ransomware incidents increased by 74% in 2023 compared to the previous year, with the average cost per incident soaring to $4.91 million. Additionally, cyberattacks on critical infrastructure like U.S. utilities experienced a nearly 70% rise in 2024. These threats expose weaknesses in existing cybersecurity frameworks, encouraging organizations to seek insurance coverage as added financial protection against legal liabilities, notification requirements, and business interruptions.

Regulatory developments also play a pivotal role in market expansion. In 2023, the U.S. Securities and Exchange Commission (SEC) implemented rules requiring public companies to disclose significant cybersecurity incidents and their risk management strategies promptly. Non-compliance invites financial penalties and reputational harm, motivating companies to purchase cyber insurance policies that cover fines, legal fees, and incident response expenses. A 2024 survey highlighted that 45% of respondents view better alignment with compliance requirements as a major area for improvement, further underscoring the market demand generated by evolving regulations.

Digital transformation and cloud adoption amplify cyber risk exposure, propelling market growth. The integration of Internet of Things (IoT) devices is expected to grow at 27% between 2024 and 2032, broadening the attack surface for cyber threats. Remote work also expanded the U.S. at least-part-time remote workforce to 22.8% (approximately 35.13 million employees) by August 2024, increasing vulnerability. As companies adopt digital payments and complex IT ecosystems, traditional cybersecurity measures struggle to keep pace. Cyber insurance emerges as a critical tool to manage these evolving risks associated with digital transformation.

To get more information on this market, Request Sample

United States Cyber Insurance Market Segmentation

IMARC Group categorizes the United States cyber insurance market by component, insurance type, organization size, and end-use industry, detailed as follows:

Breakup By Component:

- Solution: Offers risk assessment tools, data breach coverage, and liability protection products, enhanced by predictive analytics and AI for efficient customization.

- Services: Includes consulting, training, incident response, and post-incident recovery support, crucial for preparation, mitigation, and recovery from cyberattacks.

Breakup By Insurance Type:

- Packaged: Bundled cyber insurance with other business covers like general liability; favors SMEs with affordable and integrated coverage.

- Stand-alone: Tailored specifically for cyber risks, including data breach and ransomware coverage; preferred by large enterprises and regulated sectors for comprehensive protection.

Breakup By Organization Size:

- Small and Medium Enterprises: Increasing adoption due to rising cyber threat exposure, focusing on affordable packaged plans and growing awareness of financial and reputational risks.

- Large Enterprises: Demand comprehensive stand-alone policies to defend against sophisticated attacks, business disruption, and regulatory fines, supported by AI and analytics.

Breakup By End Use Industry:

- BFSI: Major market due to heightened hacking risks and regulatory compliance; policies cover fraud, identity theft, and breaches.

- Healthcare: Reliant on electronic records and connected devices; faces growing ransomware attacks; insurance mitigates data breach costs and regulatory fines.

- IT and Telecom: Hosts critical infrastructure prone to advanced threats; coverage includes third-party liability, intellectual property theft, and business disruption.

- Retail: Dependent on digital transactions; increasing cyberattacks drive demand for protection against POS breaches, supply chain issues, and reputational damage.

- Others

Regional Insights

The Northeast region dominates the U.S. cyber insurance market, driven by a significant concentration of BFSI firms requiring robust cyber risk solutions for data breaches and regulatory compliance. Large enterprises in this dense region prioritize stand-alone policies to manage ransomware and sophisticated threats. This concentration amplifies market potential. Other regions like the Midwest, South, and West have emerging and growing markets owing to industrial digitization, energy sector vulnerabilities, and technology hubs respectively.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=10537&flag=C

Recent Developments & News

In November 2024, Jencap Group, a U.S.-based wholesale insurance provider, partnered with cyber risk management platform SYBA to launch a cybersecurity product for high-net-worth individuals and family offices. The platform combines proactive cybersecurity monitoring with insurance coverage up to $5 million, including privacy-focused home monitoring and protection for household members and affiliated entities.

Also, in November 2024, Marsh introduced a program to assist organizations contracted with the Department of Defense in meeting new Cybersecurity Maturity Model Certification (CMMC) standards. This program facilitates compliance and offers additional cyber insurance coverage through participating insurers for qualifying organizations.

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302