Investing in the stock market has always been one of the most effective ways to build long-term wealth, but success depends on timing, research, and smart decision-making. One of the most searched topics among traders and investors is hot stocks today, as these stocks often show strong momentum, high trading volume, and growing investor interest. Understanding how to identify and analyze these stocks can help you make better investment choices and reduce unnecessary risk.

What Are Hot Stocks Today?

Hot stocks today are shares that are gaining attention due to price movement, news, earnings reports, sector growth, or market trends. These stocks may experience rapid price increases over a short period, making them attractive to day traders, swing traders, and even long-term investors. However, not all hot stocks are good investments, so it is important to separate hype from real value.

Stocks can become “hot” for several reasons, such as strong quarterly earnings, new product launches, mergers and acquisitions, favorable government policies, or positive industry outlooks. In some cases, market sentiment and social media buzz also play a role in pushing stocks into the spotlight.

Why Investors Track Hot Stocks Today

Tracking hot stocks today helps investors stay informed about market trends and potential opportunities. These stocks often indicate where money is flowing in the market, which sectors are performing well, and what investors are optimistic about.

For short-term traders, hot stocks can offer quick profit opportunities due to volatility and high liquidity. For long-term investors, analyzing why a stock is hot can reveal companies with strong fundamentals and growth potential. However, discipline and proper risk management are essential, as fast-moving stocks can also decline just as quickly.

Key Factors That Make a Stock Hot

Several factors contribute to a stock becoming one of the hot stocks today:

1. Strong Trading Volume

High trading volume shows increased interest from buyers and sellers. Stocks with rising volume often indicate momentum and potential price movement.

2. Positive News or Earnings

Earnings beats, revenue growth, new contracts, or expansion plans can push a stock higher. Investors closely monitor company announcements to find opportunities early.

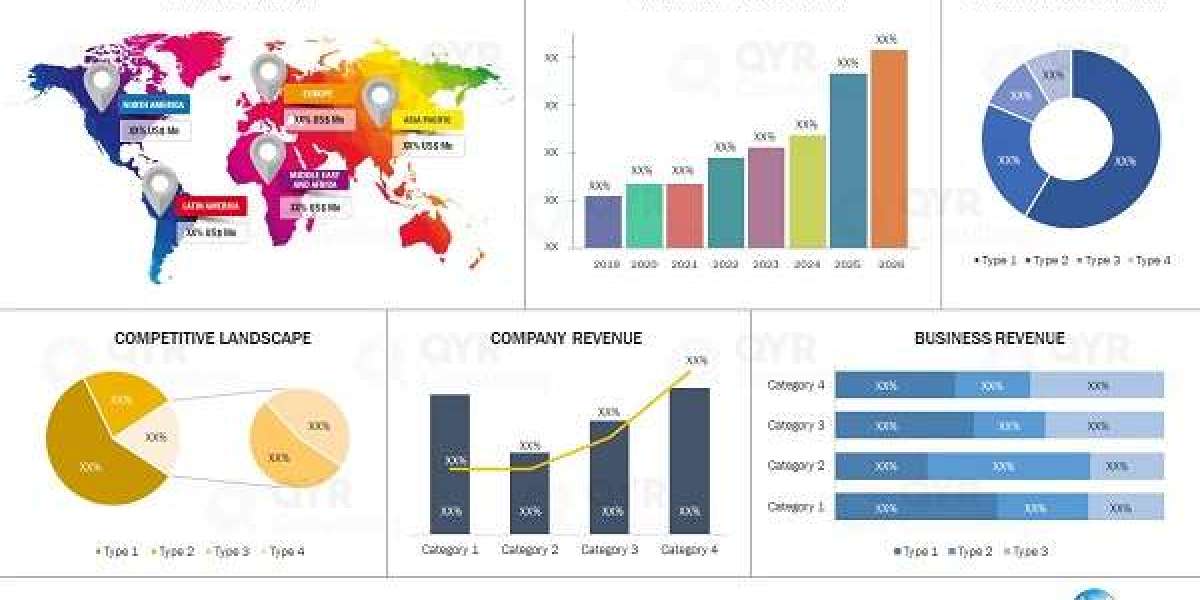

3. Sector Performance

When an entire sector performs well, stocks within that sector may become hot. Technology, energy, healthcare, and renewable energy sectors often attract attention during growth cycles.

4. Technical Breakouts

Technical traders look for price breakouts above resistance levels. These breakouts can signal the beginning of an upward trend.

5. Market Sentiment

Investor confidence, global economic conditions, and interest rate expectations can influence which stocks become popular.

How to Analyze Hot Stocks Today

Before investing in hot stocks today, proper analysis is crucial. Relying only on hype can lead to losses, so combining technical and fundamental analysis is recommended.

Fundamental Analysis:

Check company financials, revenue growth, profit margins, debt levels, and future outlook. A stock with strong fundamentals is more likely to sustain growth.

Technical Analysis:

Use charts, moving averages, RSI, and support-resistance levels to understand price trends and entry points.

Risk Assessment:

Hot stocks can be volatile. Set stop-loss levels and never invest more than you can afford to lose.

Common Mistakes to Avoid

Many investors make mistakes when chasing hot stocks today. Buying at the peak, ignoring fundamentals, or following social media tips without research can be costly. Emotional trading often leads to poor decisions, so having a clear strategy is essential.

Another mistake is putting all capital into one hot stock. Diversification helps reduce risk and protects your portfolio from sudden market changes.

Short-Term vs Long-Term Approach

Hot stocks today can suit both short-term and long-term strategies. Day traders focus on intraday price movements, while swing traders hold positions for days or weeks. Long-term investors, on the other hand, analyze whether a hot stock has sustainable growth potential.

Choosing the right approach depends on your goals, experience, and risk tolerance. Beginners should focus on learning and start with smaller investments.

Final Thoughts

Following hot stocks today can provide valuable insights into market trends and investment opportunities. However, success requires more than just spotting popular stocks. Proper research, discipline, and risk management are key to making smart investment decisions.

The stock market rewards patience, knowledge, and consistency. Whether you are a beginner or an experienced trader, staying informed and analyzing hot stocks wisely can help you grow your portfolio and achieve your financial goals over time.