IMARC Group has recently released a new research study titled “Mexico Motorcycle Tires Market Size, Share, Trends and Forecast by Tire Type, Tire Structure, Tire Category, Tire Size, Sales Channel, Location, and Region, 2026-2034” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

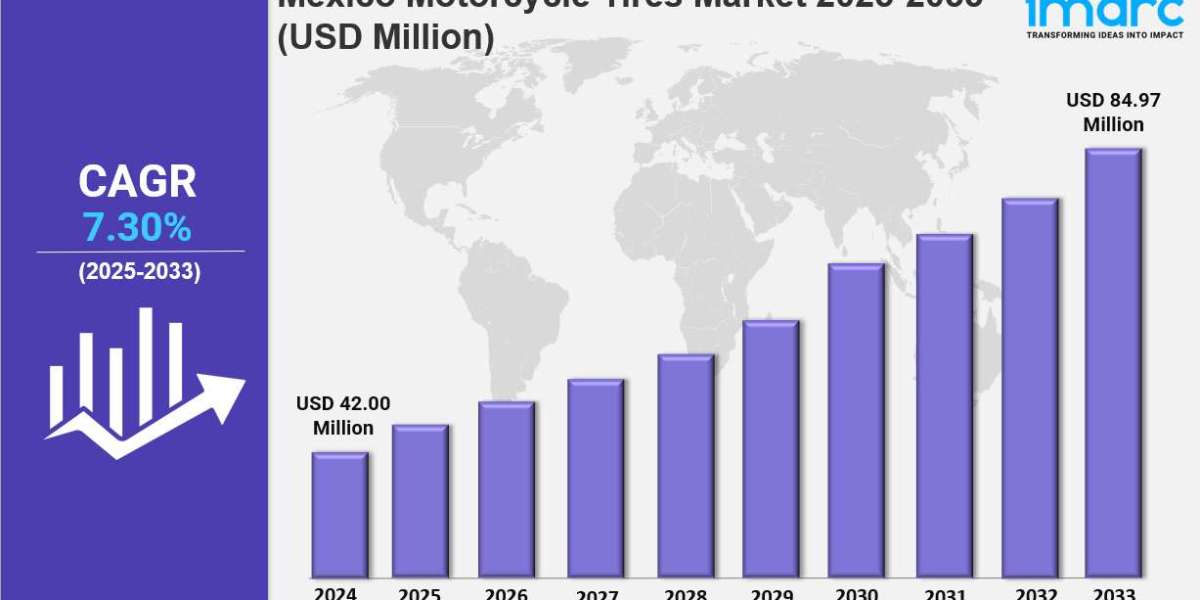

The Mexico motorcycle tires market size was valued at USD 45.19 Million in 2025 and is expected to reach USD 85.10 Million by 2034, growing at a compound annual growth rate (CAGR) of 7.29% during the forecast period from 2026 to 2034. Growth is driven by rising urbanization, increased motorcycle use for commuting and delivery services, and the growing demand for high-performance tires such as tubeless and radial tires. The expanding e-commerce and food delivery sectors in Mexico further augment demand for motorcycle tires. Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Mexico Motorcycle Tires Market Key Takeaways

- Mexico motorcycle tires market size was USD 45.19 Million in 2025.

- The market is projected to grow at a CAGR of 7.29% from 2026 to 2034.

- Tubeless tires dominate the market with a 73% share in 2025, favored for puncture resistance and low maintenance.

- Radial tires lead the tire structure segment with 58% market share due to superior handling and fuel efficiency.

- Street tires hold the largest category share at 45%, reflecting transportation and commercial delivery usage.

- The aftermarket channel commands 61% market share, driven by high replacement demand.

- Rear tires dominate with a 55% market share, owing to faster wear from load and power transmission.

Sample Request Link: https://www.imarcgroup.com/mexico-motorcycle-tires-market/requestsample

To get more information on this market, Request Sample

Mexico Motorcycle Tires Market Growth Factors

The Mexico motorcycle tires market is expanding rapidly due to explosive growth in last-mile delivery and e-commerce logistics. Approximately 70% of motorcycle sales are currently used for delivery and self-employment, generating intensive daily usage that accelerates tire wear significantly beyond typical commuting patterns. Leading platforms deploy thousands of delivery riders across Mexican cities, requiring reliable tire performance for safety and efficiency. In March 2025, Yadea announced an $80 million investment to establish a two-wheeler assembly plant in Ocoyoacac, aiming to produce 500,000 units annually by 2026, which will further drive tire demand.

Rising urbanization and traffic congestion in major metropolitan areas such as Mexico City, Guadalajara, and Monterrey are pushing motorcycle adoption as an attractive alternative to congested automobile travel. Motorcycles provide faster navigation through traffic and better fuel efficiency. These urban centers continue to experience chronic traffic saturation during peak hours, which supports a growing fleet of motorcycles. The Mexican Association of Motorcycle Manufacturers and Importers (AMFIM) projects motorcycle sales growth of 10-15% in 2025, expanding the tire consumption base proportionally.

Substantial foreign and domestic investments in tire manufacturing facilities have positioned Mexico as an emerging production hub, serving local and North American export markets. This enhances tire availability, reduces import dependency, improves pricing competitiveness, and strengthens supply chain efficiency. International tire manufacturers capitalize on Mexico's strategic location near U.S. markets, favorable USMCA trade agreements, competitive labor costs, and established automotive supply chains, all of which support efficient production operations.

Mexico Motorcycle Tires Market Segmentation

Breakup by Tire Type:

- Tube Tire

- Tubeless Tire

- Others

Tubeless tires dominate due to superior safety by resisting sudden air loss and simplified maintenance, reducing accident risks and fuel consumption. Their market share is 73% in 2025, driven by urban commuter demands and premium motorcycle adoption.

Breakup by Tire Structure:

- Radial

- Bias

- Others

Radial tires hold 58% market share, offering enhanced grip, handling, and ride comfort with better fuel efficiency. They are preferred by performance and premium motorcycle riders.

Breakup by Tire Category:

- Street Tires

- Dual Sports or Adventure Tires

- Touring Tires

- Sports/Performance Tires

- Sports Touring Tires

- Off-Roads Tires

- Racing Tires/Slicks

Street tires, with 45% market share, cater to predominant daily transportation and delivery uses, optimized for paved roads with grip and durability.

Breakup by Tire Size:

- Less than 12”

- 12”-15”

- 15”-17”

- More Than 17”

The 12”-15” size segment, making up 42% share, corresponds to standard and commuter motorcycles predominant in Mexico. This size balances agility and stability, matching price preferences.

Breakup by Sales Channel:

- OEM

- Aftermarket

The aftermarket channel leads with 61% share, driven by the large motorcycle fleet with frequent tire replacements due to daily commercial use and high mileage.

Breakup by Location:

- Front

- Rear

Rear tires dominate with 55% share as they endure more wear due to power transmission and payload, requiring more frequent replacements.

Regional Insights

Central Mexico dominates the motorcycle tires market, hosting major metropolitan areas including Mexico City, Guadalajara, and surrounding urban zones. It has the highest motorcycle density nationally, with intensive use for commuting and commercial deliveries. Central Mexico functions as the primary manufacturing and distribution hub, generating substantial demand from OEM and aftermarket channels.

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=36934&flag=C

Recent Developments & News

In November 2024, Pirelli launched Ride Passion, its first motorcycle-exclusive store in the State of Mexico at Echegaray, offering premium tires including Diablo, Scorpion, and Angel series, alongside comprehensive services like mounting, alignment, and balancing. This marked the start of Pirelli's nationwide expansion in motorcycle retail.

In March 2024, Yokohama commenced construction on a $380 million tire manufacturing facility in Saltillo, Coahuila, at Alianza Industrial Park. The plant is expected to begin production in early 2027 with a planned annual output of 5 million tires, reinforcing Mexico as a key North American production hub.

Key Players

- Pirelli

- Yokohama

- Yadea

- Grupo Salinas

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302