IMARC Group has recently released a new research study titled “US Plasmid DNA Manufacturing Market Size, Share, Trends and Forecast by Grade, Development Phase, Application, Disease, and Region, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

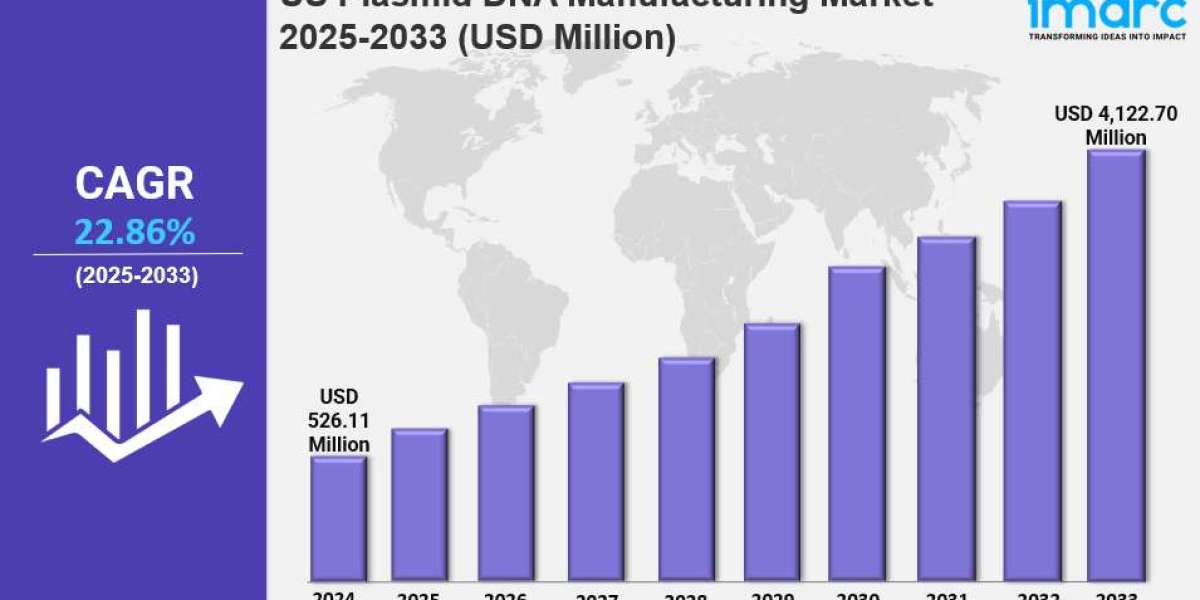

The US plasmid DNA manufacturing market size reached USD 526.11 Million in 2024 and is forecasted to grow substantially to USD 4,122.70 Million by 2033, exhibiting a robust CAGR of 22.86% during the 2025-2033 period. This growth is primarily driven by accelerated FDA approvals for cell and gene therapies and strategic manufacturing infrastructure expansions meeting rising demand. Increased government investments further bolster the market, enhancing production capacity and accessibility for gene therapy developers.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

US Plasmid DNA Manufacturing Market Key Takeaways

- Current Market Size: USD 526.11 Million in 2024

- CAGR: 22.86% during 2025-2033

- Forecast Period: 2025-2033

- The rapid FDA approvals for novel cell and gene therapies in 2024, totaling eight, are significantly driving demand for GMP-grade plasmid DNA.

- Strategic infrastructure expansions in states like Texas and New Jersey are enhancing manufacturing capacity to meet clinical and commercial-scale demands.

- Government investment, via public-private partnerships and grants, is fostering innovation and reducing reliance on foreign plasmid DNA suppliers.

- Specialized CDMOs are enabling outsourcing of complex manufacturing, accelerating development timelines and improving supply chain efficiency.

- The market is critical for therapies including CAR-T cell therapies and gene therapies targeting cancer and rare genetic disorders.

Sample Request Link: https://www.imarcgroup.com/us-plasmid-dna-manufacturing-market/requestsample

US Plasmid DNA Manufacturing Market Growth Factors

The US plasmid DNA manufacturing market is propelled by the accelerated pace of FDA approvals for cell and gene therapies. In 2024, the FDA approved eight novel therapies, a notable increase indicating regulatory momentum toward 10 to 20 annual approvals by 2025. This surge boosts demand for GMP-grade plasmid DNA, essential as the starting material for viral vector production in gene therapies and direct therapeutic use in DNA vaccines. The 2025 approvals of therapies like Libmeldy for metachromatic leukodystrophy and BEQVEZ™ for hemophilia B further exemplify this growing market demand, especially for applications supporting CAR-T and engineered cell therapies targeting cancer and genetic disorders.

Strategic expansion of manufacturing infrastructure is meeting unprecedented demand fueled by growing cell and gene therapy development. Notably, in 2024, Bionova Scientific announced a dedicated plasmid DNA manufacturing facility in The Woodlands, Texas, with GMP capabilities launching in late 2025. Similarly, ProBio's 128,000 square foot Cell and Gene Therapy Center of Excellence in Hopewell, New Jersey, established over 110 skilled jobs and serves as a North American hub for plasmid DNA and viral vector manufacturing. These expansions feature advanced single-use technologies and automated purification, reducing production timelines and ensuring regulatory compliance.

Government investment is accelerating innovation and market growth through increased funding for advanced genetic research and gene therapy production. These investments facilitate construction of advanced plasmid DNA production facilities and foster public-private partnerships between research centers and biotech firms. By supporting research programs and capacity-building grants, the government enhances domestic production capacity, reducing reliance on imports. Favorable regulatory frameworks are advancing technological progress, scalability, and adoption of plasmid DNA across vaccines, gene therapies, and cell-based therapeutics.

To get more information on this market, Request Sample

US Plasmid DNA Manufacturing Market Segmentation

Breakup By Grade:

- R&D Grade: Viral Vector Development (AAV, Lentivirus, Adenovirus, Retrovirus, Others)

- mRNA Development

- Antibody Development

- DNA Vaccine Development

- Others

The market is categorized based on research and development grades including various viral vectors used for gene therapies, mRNA, antibody and DNA vaccine development, and other categories.

Breakup By Development Phase:

- Pre-Clinical Therapeutics

- Clinical Therapeutics

- Marketed Therapeutics

Segments are defined by phases of therapeutic development, covering early pre-clinical to fully marketed products.

Breakup By Application:

- DNA Vaccine

- Cell and Gene Therapy

- Immunotherapy

- Others

Applications include DNA vaccines, cell and gene therapies, immunotherapies, and additional uses.

Breakup By Disease:

- Infectious Disease

- Cancer

- Genetic Disorder

- Others

Diseases targeted by plasmid DNA include infectious diseases, cancer, genetic disorders, among other conditions.

Regional Insights

The report segments the US plasmid DNA manufacturing market regionally into Northeast, Midwest, South, and West. However, specific dominant regional market share statistics or CAGR values are not provided in the source. The report offers comprehensive regional analysis for all these major US markets.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=43510&flag=C

Recent Developments & News

- July 2025: Charles River Laboratories International and Elly's Team formed a CDMO agreement for plasmid DNA production, utilizing Charles River's eXpDNA™ plasmid platform and ready-to-use AAV Rep/Cap plasmids to support a Phase I clinical trial.

- April 2024: Charles River Laboratories International and Ship of Theseus announced a CDMO agreement for GMP plasmid DNA production. Ship of Theseus will use Charles River's expertise to produce plasmid DNA as the active drug substance for therapeutic candidates addressing diabetic wounds, neutropenia, psoriasis, androgenetic alopecia, women's health, infertility, and epithelial cancers.

Competitive Landscape

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302