IMARC Group has recently released a new research study titled “North America Pectin Market Size, Share, Trends and Forecast by Raw Material, End Use and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

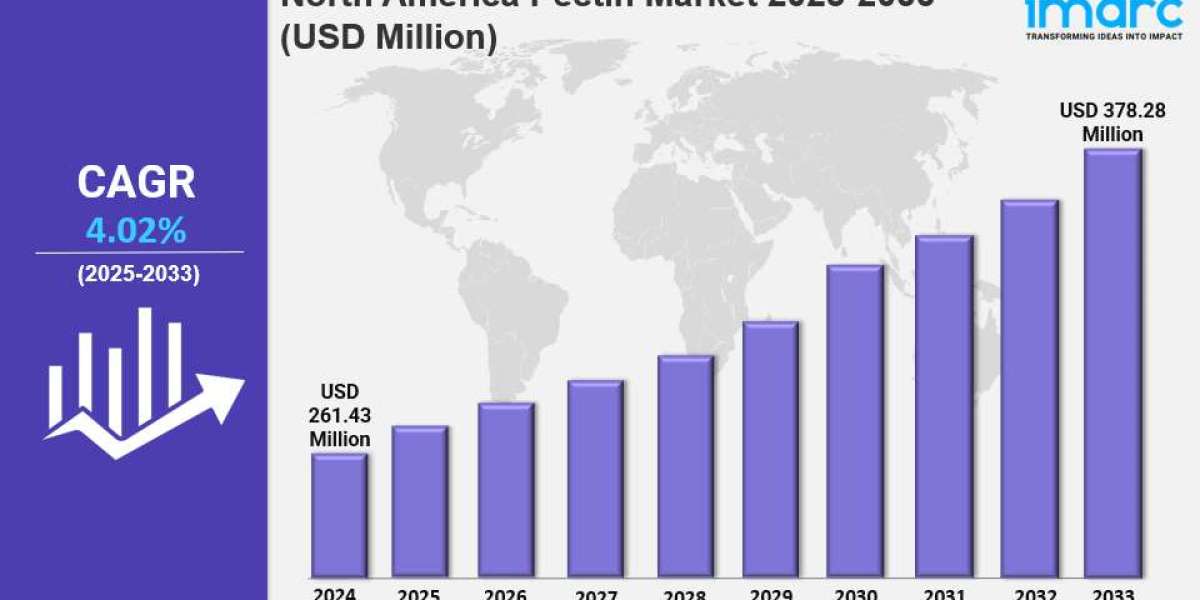

The North America pectin market size was valued at USD 261.43 Million in 2024 and is projected to reach USD 378.28 Million by 2033, growing at a CAGR of 4.02% during 2025-2033. Market growth is driven by increasing demand for clean-label and natural food ingredients, expanding applications in dairy, beverages, pharmaceuticals, and personal care, alongside a rising consumer preference for plant-based gelling agents.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

North America Pectin Market Key Takeaways

- Current Market Size: USD 261.43 Million in 2024

- CAGR: 4.02% from 2025-2033

- Forecast Period: 2025-2033

- The market is primarily influenced by consumer preference for clean-label and natural ingredients, especially in organic and functional foods.

- Rising use in dairy and beverage sectors adds structure and stability to yogurts, fruit drinks, and plant-based dairy alternatives.

- Increasing demand for plant-based and vegan ingredients is fostering growth, with pectin serving as a natural alternative to animal-derived stabilizers.

- Expansion in functional and reduced-sugar food products supports market development, driven by health-conscious consumption and regulatory sugar reduction pressures.

- Growing adoption in pharmaceutical and personal care industries is due to pectin's biocompatibility and functional benefits in drug delivery and skincare products.

Sample Request Link: https://www.imarcgroup.com/north-america-pectin-market/requestsample

North America Pectin Market Growth Factors

The North America pectin market growth is propelled by rising consumer preference for clean-label and natural food ingredients. As awareness of artificial additives and synthetic stabilizers increases, food manufacturers are substituting these with natural alternatives like pectin derived from citrus fruits and apples. Pectin provides natural gelling, thickening, and stabilizing effects, particularly in jams, jellies, and dairy products. Regulatory support for clean-label formulations complements increasing consumer scrutiny of ingredient lists, especially in organic and functional foods emphasizing minimally processed ingredients.

Another significant growth driver is the expanding demand for pectin in the dairy and beverage sector. Pectin contributes to the structure and stability of products like yogurt, fruit-based drinks, and plant-based dairy alternatives, aligning with increasing demand for non-dairy and functional beverages. It acts as a natural stabilizer in low-sugar and reduced-calorie products, improving mouthfeel and viscosity without synthetic additives. The growing market for nutrient-rich drinks, including probiotic-enhanced milk and other milk-based products, depends on pectin incorporation. Innovations such as high-pulp juice formulations further bolster this trend.

The rising adoption of pectin in pharmaceutical and personal care sectors also supports market growth. Due to its biocompatibility and functional properties, pectin is utilized as an excipient in drug delivery systems, wound healing products, and digestive health supplements, benefiting from its gelling and fiber content. In personal care, its hydrating and film-forming properties make it a favored ingredient in skincare, hair care, and cosmetics. The clean-label movement in beauty and healthcare sectors highlights botanical and non-synthetic ingredients, positioning pectin as a sustainable and functional choice.

To get more information on this market, Request Sample

North America Pectin Market Segmentation

Breakup By Raw Material:

- Citrus Peel: Holds the majority share due to high pectin content, cost-effectiveness, and availability. Derived mainly from oranges and lemons, it offers superior gelling and stabilizing properties favored in food and beverage applications. The strong citrus processing industry in the U.S. provides a consistent raw material supply, supported by sustainability initiatives promoting fruit byproduct utilization.

- Apple Peel

- Others

Breakup By End Use:

- Jams and Preserves: Dominate the market due to high dependence on pectin for gelling and thickening. Consumer preference for natural, reduced-sugar spreads, and homemade artisanal jams boosts demand. Trends toward clean-label and organic products reinforce pectin usage.

- Drinkable and Spoonable Yoghurt: Growing incorporation aligns with demand for natural stabilizers in dairy.

- Bakery and Confectionary

- Fruit Beverages: Increasingly use pectin to improve texture and stability.

- Other Milk Drinks

- Others

Breakup By Country:

- United States: Holds majority market share driven by a strong food and beverage industry, demand for clean-label ingredients, and advanced manufacturing capabilities. Benefits from robust supply chains and ongoing R&D in pharmaceuticals and personal care applications.

- Canada

Regional Insights

The United States dominates the North America pectin market due to its established food and beverage industry and strong consumer demand for natural thickeners in dairy, bakery, and confectionery products. The country’s focus on reduced-sugar formulations in jams, jellies, and functional beverages supports growth. The robust supply chain with domestic and imported citrus and apple processing ensures steady raw material availability, further reinforcing its market leadership.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1796&flag=C

Recent Developments & News

In November 2024, Tate & Lyle completed its acquisition of CP Kelco from J.M. Huber Corporation, enhancing its position in the specialty food and beverage market. This acquisition includes CP Kelco’s operations in the U.S., China, and Denmark, expanding Tate & Lyle’s portfolio in pectin, specialty gums, and natural ingredients. In March 2024, Captek Softgel International inaugurated its first gummy manufacturing facility in La Mirada, CA, capable of producing 1.5 billion gummies annually using pectin, agar, carrageenan, and gelatin. The SQF-certified plant aims for organic, kosher, and halal certifications to boost nutraceutical gummy offerings.

Key Players

- Tate & Lyle

- CP Kelco

- Captek Softgel International

Competitive Landscape

The market research report covers a comprehensive competitive landscape analysis including market structure, key player positioning, winning strategies, competitive dashboards, and company evaluation quadrants. Detailed profiles of all major companies have been provided.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302