I’ve spent the last decade working with high-risk merchants, and I’ve watched countless businesses celebrate revenue growth while secretly bleeding money. The culprit? A fundamental misunderstanding of what profitability actually means when you’re processing thousands of transactions daily.

Last month, I talked to a supplement company doing $2.3 million in monthly revenue. Their founder was ecstatic about their growth trajectory until I asked one simple question: “After chargebacks, failed transactions, and processing fees, what’s your actual profit per customer?” The silence on the call told me everything I needed to know.

The Hidden Profitability Killers Nobody Talks About

When most merchants think about profitability analysis, they focus on the obvious stuff like cost of goods sold and advertising spend. But in the payment processing world, there are invisible profit drains that can turn a seemingly healthy 30% margin into a razor-thin 8% overnight.

I learned this the hard way, working with an online education platform. On paper, they were crushing it with a 40% gross margin. But when we dug into their payment data, we discovered they were losing 18% of revenue to failed transactions that could have been recovered. Another 7% was disappearing to chargebacks that were never properly contested.

The reality? True profitability for merchants processing online payments requires looking beyond traditional P&L statements. You need to understand the complete transaction lifecycle, from the moment a customer clicks “buy” to when that money actually lands in your bank account, minus all the hidden fees.

Breaking Down Real Merchant Profitability

Let me show you what actual profitability looks like for a typical high-risk merchant. I’m using real numbers from a client I worked with last quarter (details changed for privacy, obviously).

They started with $500,000 in gross sales. Sounds great, right? Here’s where it gets interesting. Their payment processor approved only 78% of transactions on the first attempt. That’s $110,000 in failed revenue right off the bat. Of those failures, about 40% were legitimate declines, but the remaining 60% were soft declines that could potentially be recovered through intelligent retry logic.

Then came the chargebacks. In high-risk industries, a 2–3% chargeback rate isn’t unusual. For this client, that meant $15,000 in disputed transactions monthly. But here’s what most merchants miss: each chargeback comes with fees, regardless of whether you win the dispute. That’s another $3,750 minimum in pure loss.

Processing fees took another 4.5% ($22,500), and then there were the gateway fees, PCI compliance costs, and fraud prevention tools. By the time we finished the analysis, their $500,000 in gross sales translated to $310,000 in actual collectible revenue. That’s a 38% reduction before they even touched their operating expenses.

The Transaction Success Blindspot

Most payment analytics platforms show you approval rates, but they don’t show you the why behind the failures. I’ve seen merchants obsessing over a 75% approval rate without realizing that 15% of their declines are happening because they’re routing transactions through the wrong processor for specific card types or geographic regions.

One e-commerce brand I worked with was losing $40,000 monthly by routing all their European transactions through a US-based processor. The approval rate for those transactions was 62% compared to 81% for domestic transactions. When we implemented smart payment routing based on card origin and transaction type, their European approval rate jumped to 79% within two weeks.

This is where profitability analysis goes beyond spreadsheets. You need real-time intelligence that connects your revenue data with payment performance metrics. Otherwise, you’re flying blind, celebrating revenue numbers that don’t reflect the money actually hitting your account.

The Chargeback Profitability Trap

Here’s something that shocked me when I first started in this industry: winning a chargeback dispute doesn’t mean you’re profitable on that transaction. Even if you successfully prove the transaction was legitimate, you’ve spent time, resources, and dispute fees fighting it. Many merchants don’t factor these operational costs into their profitability calculations.

I worked with a subscription box company that was winning 70% of its disputes. Impressive, right? But when we calculated the total cost of their dispute management, including staff time, evidence gathering, and fees, they were spending $47 per dispute. With 200 monthly disputes, that’s $9,400 in pure overhead that never appeared on their profitability statements.

The smarter approach? Prevent chargebacks before they happen through automated alert systems and proactive customer communication. Understanding the difference between chargebacks and refunds is critical. It’s significantly cheaper to resolve a customer complaint before it becomes a dispute than to fight the chargeback after it’s filed.

Building a Real-Time Profitability Framework

Traditional profitability analysis happens monthly or quarterly. That’s like driving by looking in the rearview mirror. In the payment processing world, you need real-time visibility into the metrics that actually impact your bottom line.

I recommend merchants track these core profitability indicators daily: net transaction approval rate (first attempt approvals plus successful retries), effective processing cost (total fees divided by successful transactions), chargeback ratio with associated costs, and revenue recovery rate from failed transactions.

When you monitor these metrics in real-time, you can spot problems before they devastate your monthly numbers. I’ve seen merchants identify processor issues within hours instead of discovering them at month-end when it’s too late to recover the lost revenue.

The Data Integration Challenge

One of the biggest obstacles I see with profitability analysis is data fragmentation. Your sales data lives in Shopify, payment data in your processor dashboard, chargeback information in yet another system, and your accounting in QuickBooks. Building an accurate profitability picture requires integrating all these data sources.

Most merchants try to do this manually with spreadsheets. I respect the hustle, but I’ve never seen this approach scale beyond $1 million in annual revenue. The margin for error is too high, and the time investment doesn’t justify the results.

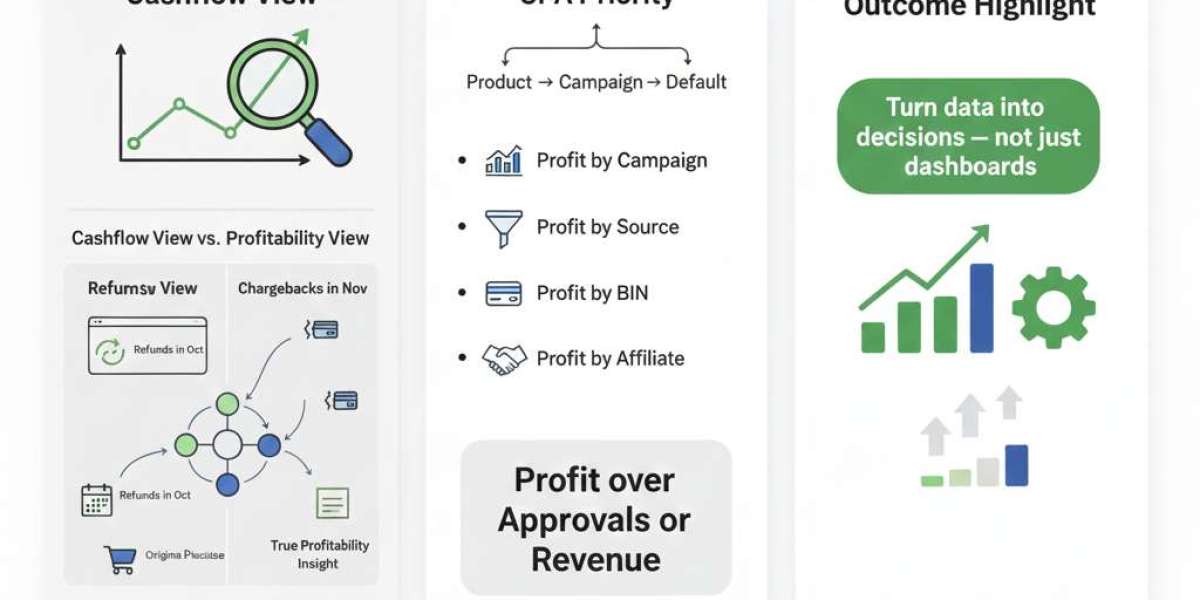

The businesses that truly understand their profitability use unified analytics platforms that automatically pull data from all payment touchpoints. This gives you a single source of truth for profitability metrics without the manual reconciliation headaches. Gateway compliance monitoring becomes seamless when your data flows into one system.

The Profit Recovery Opportunity

Here’s the exciting part: once you understand where your profitability is leaking, you can plug those holes systematically. Based on my experience, most merchants can improve their net profitability by 15–25% without increasing sales, just by optimizing their payment operations.

Start with the low-hanging fruit. Implement intelligent retry logic for soft declines. That alone typically recovers 3–5% of otherwise lost revenue. Next, optimize your payment routing to send transactions to the processors most likely to approve them based on transaction characteristics. This can boost your overall approval rate by 5–10 percentage points.

Then tackle chargeback prevention through automated alerts and better customer service workflows. Even reducing your chargeback rate from 2% to 1.5% can save tens of thousands in fees and recovered revenue for a mid-sized merchant. Don’t forget about friendly fraud, which now accounts for 70–80% of all chargebacks.

Why Most Profitability Tools Miss the Mark

I’ve evaluated dozens of analytics platforms over the years, and most fall into one of two categories: they’re either generic business intelligence tools that don’t understand payment nuances, or they’re processor-specific dashboards that only show you part of the picture.

What merchants really need is payment-specific profitability intelligence that understands the complete transaction lifecycle. This means tracking not just successful payments, but failed transactions, partial refunds, dispute costs, and all the associated fees that chip away at your margins.

The best profitability analysis happens when you can see correlations between payment performance and business outcomes. For example, does your approval rate drop on certain days of the week? Do specific products have higher chargeback rates? Is one processor consistently underperforming for certain transaction types? Understanding MID health is crucial for maintaining optimal approval rates.

Taking Action on Profitability Insights

Data without action is just interesting numbers. The merchants who truly benefit from profitability analysis are the ones who build it into their operational decision-making. This means setting up alerts for metric thresholds, establishing weekly review processes, and empowering teams to make real-time adjustments.

I recommend starting with a profitability baseline audit. Pull together all your payment data from the last 90 days and calculate your true net revenue after all payment-related costs. Compare this to your gross sales. The gap between these numbers represents your opportunity for improvement.

Then prioritize based on impact and effort. Quick wins like fixing processor routing issues or implementing basic retry logic should come first. Longer-term improvements like comprehensive chargeback prevention programs can follow once you’ve captured the easy gains. Pre-authorization charges can also help validate payment methods before fulfillment, reducing failed captures.

The Future of Payment Profitability

The merchant processing landscape is evolving rapidly. With real-time payment networks, AI-powered fraud detection, and sophisticated routing algorithms, the gap between merchants who understand profitability and those who don’t will only widen.

I’m seeing early adopters use machine learning to predict which transactions are likely to result in chargebacks before they even process. Others are using predictive analytics to forecast monthly profitability with remarkable accuracy, allowing them to make proactive adjustments instead of reactive fixes.

The key is building profitability intelligence into your core operations rather than treating it as a monthly reporting exercise. When every team member understands how their decisions impact transaction success rates and dispute ratios, you create a culture of profitability optimization that compounds over time.

Watch: Deep Dive into Payment Profitability Metrics

Want to see these concepts in action? I’ve created a detailed walkthrough of the exact profitability metrics you should be tracking and how to interpret them for your business. This video breaks down real merchant data and shows you exactly where profit leaks happen and how to plug them.

Watch the full profitability analysis breakdown on YouTube

In this video, you’ll discover:

- The three profitability metrics 99% of merchants ignore (but shouldn’t)

- How to calculate your true transaction success rate beyond simple approval rates

- Real examples of merchants who recovered 15–30% in lost revenue

- The exact payment data integration strategy I use with clients

Conclusion: The Path to True Profitability

Your payment data tells a story about your business health, but only if you know how to read it. Most merchants are leaving significant profit on the table simply because they’re measuring the wrong things or not measuring frequently enough. The good news? Once you understand true profitability, the path to improvement becomes remarkably clear.

Here’s what you need to remember:

Profitability isn’t just revenue minus costs. For payment businesses, it’s revenue minus failed transactions, minus chargebacks and their fees, minus processing costs, minus dispute management overhead. Every layer matters.

Real-time monitoring beats monthly reports. The merchants winning today are tracking payment performance metrics daily, spotting issues within hours, and recovering revenue that would have been lost in traditional monthly analysis cycles.

Integration is non-negotiable. Spreadsheets might work when you’re starting out, but true profitability intelligence requires unified data from all your payment touchpoints. The time you save on manual reconciliation pays for itself within weeks.

Recovery is your biggest opportunity. Between failed payment recovery, intelligent routing, and chargeback prevention, most merchants can boost net profitability by 15–25% without acquiring a single new customer.

Start by questioning your current profitability metrics. Are you accounting for all payment-related costs? Do you understand your true approval rate including retries? Can you trace a dollar from customer purchase to bank deposit? If not, it’s time to build a more complete picture of where your money actually goes.

The merchants who master profitability analysis don’t just survive in high-risk industries. They thrive. They make better decisions faster, recover revenue others lose, and build sustainable businesses that can weather processor changes, regulation shifts, and market volatility.

Your future self will thank you for taking profitability seriously today.

Ready to Stop Leaving Money on the Table?

If you’re tired of celebrating revenue numbers that don’t match what hits your bank account, it’s time to see what real payment intelligence looks like. Beast Insights helps high-risk merchants recover lost revenue, prevent chargebacks, and optimize payment routing to maximize profitability.

Schedule a free profitability audit and discover exactly where your payment operations are leaking profit. We’ll analyze your last 90 days of transaction data and show you specific opportunities for improvement, no commitment required.

Or explore our payment intelligence platform to see how unified payment analytics can transform your profitability from a monthly surprise into a daily competitive advantage.