IMARC Group has recently released a new research study titled “Mexico Galvanization Market Size, Share, Trends and Forecast by Type, Combustion Chamber Type, Application, End Use Industry, and Region, 2026-2034”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

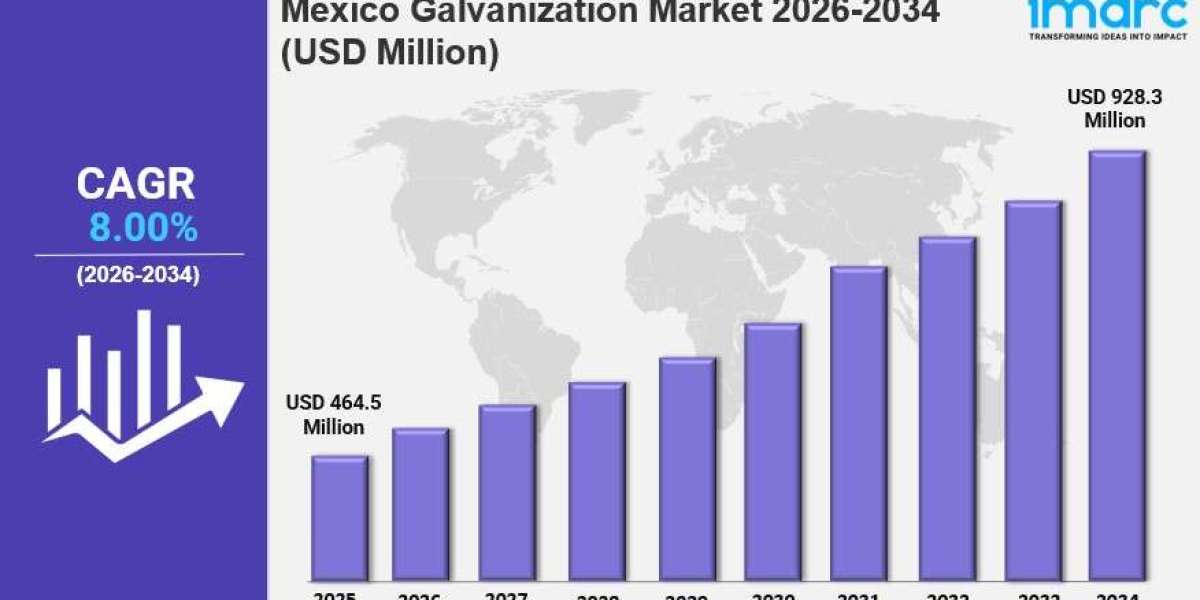

The Mexico galvanization market size was valued at USD 464.5 Million in 2025. It is expected to grow at a CAGR of 8.00% from 2026 to 2034, reaching USD 928.3 Million by 2034. This growth is driven by increased demand from construction and automotive sectors, infrastructure development, corrosion protection awareness, government regulations favoring galvanized steel, and expanding industrial and manufacturing activities in Mexico.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Mexico Galvanization Market Key Takeaways

- Current Market Size: USD 464.5 Million in 2025

- CAGR: 8.00% (2026-2034)

- Forecast Period: 2026-2034

- The market is expanding significantly due to growing galvanized steel demand in automotive, construction, renewable energy, and agriculture sectors.

- Manufacturers are investing in new galvanizing equipment and infrastructure to boost capacity.

- Advanced galvanizing technologies are being adopted for improved production efficiency and corrosion resistance.

- Partnerships between major companies, such as Ternium and DUMA-BANDZINK, are strengthening market growth.

- Government regulations promote the use of galvanized steel to enhance durability and performance.

Sample Request Link: https://www.imarcgroup.com/mexico-galvanization-market/requestsample

Market Growth Factors

Mexico’s infrastructure modernization initiatives are driving extensive use of corrosion-resistant materials across transportation, utilities, and public facilities, thereby accelerating Mexico galvanization market demand. Government investments, including a MX$53.3 Billion plan announced in June 2025 under the National Highway Infrastructure Program, aim to modernize roads, bridges, and priority corridors. Urban development addressing housing shortages and commercial needs further stimulates consumption of galvanized roofing, framing, and reinforcement products. The expansion of industrial zones and logistics facilities demands durable building materials. Improvements in municipal infrastructure such as water treatment and public transit specify galvanized components for long-term reliability.

The automotive sector’s continued growth in Mexico creates sustained demand for galvanized steel in vehicle panels and structural components. Rising quality requirements and warranty standards push automakers to adopt premium galvanized materials ensuring vehicle durability. Expansion is supported by new and enlarged assembly plants, such as JAC Motors’ 30% capacity increase announced in March 2025 at its Ciudad Sahagún plant. Tier-one suppliers require dependable galvanizing services for just-in-time production. The trend toward electric vehicles opens opportunities for specialized corrosion-resistant materials for battery enclosures and platforms.

Mexico's renewable energy growth drives the need for galvanized structural components supporting solar and wind power facilities. Solar mounting systems must maintain integrity over time in varied climates. In 2024, distributed solar installations reached 1.09 GW, raising total capacity to 4.42 GW with over 106,900 new interconnections. Wind turbines also require galvanized towers and ancillary structures resistant to coastal and desert environmental factors. Transmission infrastructure relies on galvanized poles and towers for electricity distribution. Government commitments to increase renewable energy capacity provide long-term visibility and opportunities for galvanizing service providers.

To get more information on this market Request Sample

Market Segmentation

Breakup by Type:

- Hot-Dip Galvanizing: Involves dipping steel into molten zinc to provide corrosion protection through a durable coating.

- Electro Galvanizing: Uses electrical current to coat steel with zinc, enhancing corrosion resistance suitable for various applications.

- Cold Galvanizing: Application of zinc-rich paint to provide surface protection for steel without heat treatment.

- Zinc Galvanizing: General term for coating steel with zinc for anti-corrosion, includes various methods.

- Centrifugal Galvanizing: Steel parts are coated by centrifugal force distributing molten zinc evenly.

- Trivalent Galvanizing: Utilizes trivalent chromium compounds for environmentally friendlier corrosion protection.

- Roto Barrel Galvanizing: Process suitable for batch galvanizing small parts using a rotating barrel.

- Mechanical Galvanizing: Coating applied via mechanical impact rather than dipping or electroplating.

- Bolts and Nuts Galvanizing: Specialized galvanizing focused on fasteners providing corrosion resistance.

- Others

Breakup by Combustion Chamber Type:

- Oil: Uses oil as combustion source in galvanizing operations.

- Gas: Employs gas fuel for heating in the galvanizing process.

- Electric: Electric power is utilized for combustion or heating in galvanizing.

- Others

Breakup by Application:

- Fencing: Galvanized steel used for durable fencing solutions.

- Metal Framing: Structural metal framing coated for corrosion protection.

- Staircase: Galvanized steel components used in stair construction.

- Steel Joists: Joists protected with galvanizing for longevity.

- Rails: Steel rails coated to resist environmental effects.

- Nails: Fasteners galvanized to prevent rust.

- Tubing: Galvanized steel tubes used in various structural and industrial applications.

- Poles: Supporting poles galvanized for durability.

- Others

Breakup by End Use Industry:

- Electrical and Electronics: Galvanized steel components used in electronic assemblies.

- Wind and Solar Industries: Galvanized steel for renewable energy infrastructure.

- Energy Industry: Use in broader energy sector applications.

- Telecommunications Industry: Components protected by galvanizing for telecom infrastructure.

- Transportation: Aerospace, Marine, Automotive, and other transportation sectors utilizing galvanized steel.

- Building and Construction:

- Residential Construction: Homes and housing projects using galvanized steel.

- Commercial Construction: Commercial buildings employing galvanized materials.

- Industrial: Industrial facilities using galvanized steel elements.

- Infrastructure: Infrastructure projects requiring corrosion-resistant steel.

- Others: Additional industries using galvanized steel.

Regional Insights

Dominant regions include Northern Mexico, Central Mexico, and Southern Mexico, with others also accounted for. The report provides a comprehensive regional market analysis covering these areas but does not specify market shares or CAGR by region. These regions collectively drive the Mexico galvanization market's growth due to industrialization and infrastructure development.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=35883&flag=C

Recent Developments & News

In January 2024, Ternium, a leading Latin American steel manufacturer, selected DUMA-BANDZINK equipment to expand its Pesquería Industrial Center in Mexico. This development includes a hot-dip galvanizing line set to produce 600,000 tons of galvanized steel annually targeting automotive, construction, renewable energy, and agriculture sectors. This investment is Ternium's largest to date and strengthens its partnership with DUMA-BANDZINK, which was instrumental in modernizing Ternium Monterrey facilities.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: [email protected],

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302