The latest edition of the SPARK Matrix Financial Close Management study by QKS Group delivers a powerful, data-driven perspective on one of the most critical domains in modern finance. As enterprises accelerate digital transformation, finance teams are under increasing pressure to close books faster, ensure regulatory compliance, and provide real-time insights that guide executive decisions. This research has been developed to equip technology vendors with strategic intelligence while enabling buyers to evaluate the competitive landscape with clarity and confidence.

Through in-depth analysis, the SPARK Matrix Financial Close Management study explores how innovation, automation, and intelligent platforms are reshaping the global financial close ecosystem. It provides actionable intelligence that supports vendors in refining their market positioning, strengthening product strategies, and identifying growth opportunities in a highly competitive environment.

Comprehensive Market Coverage and Strategic Insights

QKS Group’s research offers a holistic view of the Financial Close Management market, combining market trends, emerging technologies, competitive intelligence, and forward-looking insights.

- Emerging Technology Trends

The study highlights transformative trends redefining financial close processes:

- Unified Cloud-Native Platforms: Vendors are shifting toward scalable, cloud-first architectures that enable seamless deployment, remote collaboration, and global standardization.

- AI-Driven Automation: Intelligent automation is minimizing manual interventions, reducing errors, and accelerating reconciliation and reporting cycles.

- Deep ERP Integrations: Robust integrations with enterprise resource planning systems ensure real-time data synchronization and enhanced operational efficiency.

- Advanced Analytics and Predictive Insights: Modern platforms are embedding analytics that empower finance leaders to move beyond historical reporting toward predictive and scenario-based decision-making.

- Enhanced Compliance and Governance Capabilities: Automated controls, audit trails, and regulatory frameworks strengthen transparency and accountability.

- Market Trends and Outlook

The financial close management market is witnessing significant momentum as organizations demand:

- Shorter closing cycles

- Increased transparency

- Greater financial control

- Real-time reporting accuracy

- Improved collaboration across departments

As finance evolves from a transactional function to a strategic business partner, technology investments in financial close management are becoming central to enterprise transformation strategies. The study provides a forward-looking outlook, outlining expected growth patterns, adoption dynamics, and competitive shifts shaping the years ahead.

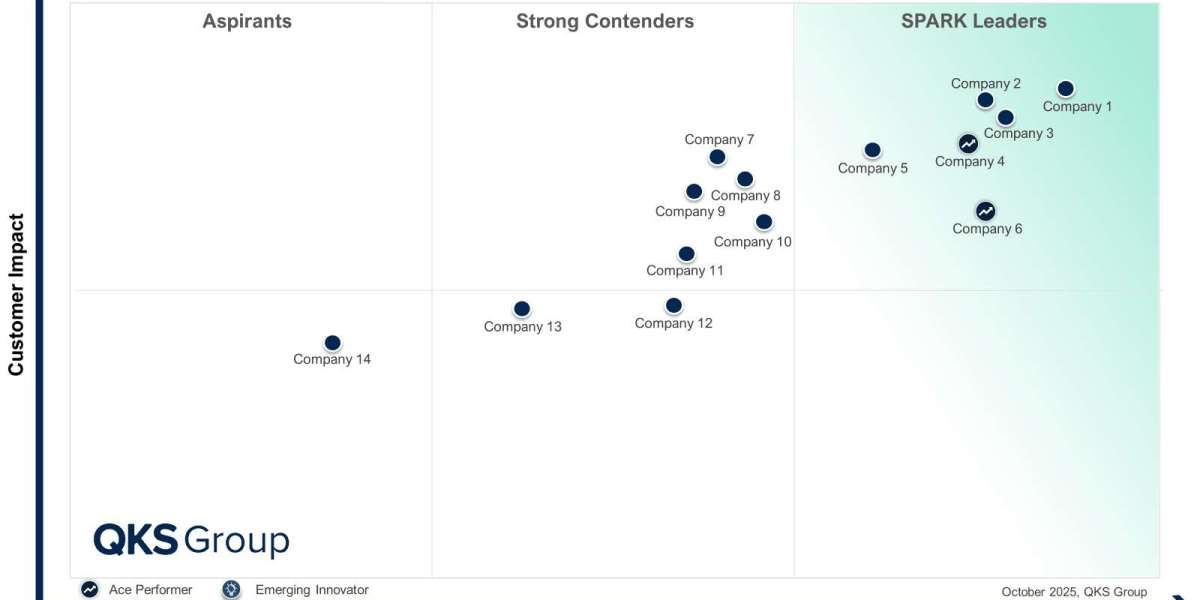

The SPARK Matrix: A Competitive Benchmarking Framework

At the core of the study lies the proprietary SPARK Matrix Financial Close Management evaluation framework. This structured methodology ranks and positions leading vendors based on technology excellence and customer impact.

The SPARK Matrix offers:

- Competitive Differentiation Analysis: Clear visibility into how vendors compare across innovation, scalability, integration capabilities, and customer value.

- Vendor Positioning: A quadrant-based ranking system that highlights market leaders, innovators, and emerging players.

- Strategic Benchmarking: A transparent evaluation model that supports informed decision-making for both vendors and buyers.

This competitive assessment covers globally impactful vendors, including:

- Anaplan

- BlackLine

- Board

- Cube

- Datarails

- SAP

- FloQast

- Trintech

- IBM

- insightsoftware

- Jedox

- OneStream Software

- Oracle

- Planful

- Prophix

- Redwood Software

- Vena Solutions

- Wolters Kluwer

- Workday

By evaluating these vendors within a consistent and transparent framework, the study provides unmatched visibility into competitive strengths and innovation trajectories.

Empowering Vendors with Actionable Intelligence

For technology vendors, this study serves as a strategic playbook to navigate evolving market demands. It enables organizations to:

- Assess their competitive standing within the global ecosystem

- Identify strengths and areas of improvement

- Align product innovation with market expectations

- Refine go-to-market strategies

- Highlight differentiated value propositions

With finance leaders prioritizing automation, compliance, and advanced analytics, vendors must demonstrate not only technological excellence but also measurable customer impact. The insights from this research help vendors articulate their differentiation clearly and credibly.

Supporting Buyers in Strategic Vendor Selection

The research is equally valuable for enterprises evaluating financial close management solutions. Buyers gain:

- An objective assessment of vendor capabilities

- A clear understanding of market positioning

- Insight into integration, automation, and scalability strengths

- Guidance on long-term platform viability

As financial processes grow more complex, selecting the right technology partner becomes critical. The SPARK Matrix Financial Close Management evaluation offers decision-makers the clarity needed to invest with confidence.

Market Momentum and the Evolution of Finance

The financial close management market is entering a phase of accelerated innovation. Vendors are embracing:

- AI-powered reconciliations

- Workflow automation

- Real-time dashboards

- Collaborative financial planning

- End-to-end compliance management

These advancements are enabling organizations to:

- Close books faster

- Improve reporting accuracy

- Enhance operational transparency

- Reduce risk exposure

- Drive strategic, data-informed decision-making

Modern financial close solutions are no longer limited to period-end tasks. They are becoming integral to enterprise performance management, helping finance leaders shift from reactive reporting to proactive strategy formulation.

As businesses operate in increasingly volatile and competitive environments, the ability to deliver accurate, real-time financial intelligence is becoming a decisive advantage.

Why This Study Matters Now

The convergence of automation, cloud computing, and AI is redefining the finance function. Enterprises are seeking platforms that unify workflows, eliminate silos, and provide predictive insights. Vendors that can deliver integrated, scalable, and intelligent solutions are positioned to lead the next wave of transformation.

This research captures that inflection point. By combining market intelligence, competitive benchmarking, and future outlook analysis, it delivers a comprehensive resource for organizations aiming to lead—not follow—in financial close innovation.

Conclusion: A Strategic Guide for the Future of Financial Close

The SPARK Matrix Financial Close Management study stands as a definitive guide to understanding the competitive dynamics and innovation landscape of the global market. It equips vendors with the insights needed to sharpen strategy and strengthen positioning, while empowering buyers with clarity in vendor evaluation.

As finance teams continue evolving into strategic drivers of enterprise growth, investments in intelligent, cloud-native, and AI-enabled financial close platforms will remain central to transformation agendas. This research not only highlights the current leaders but also anticipates the direction of future innovation.

Organizations that leverage the insights from the SPARK Matrix Financial Close Management evaluation will be better prepared to accelerate growth, enhance transparency, and deliver sustainable value in an increasingly data-driven world.

#FinancialCloseManagement #SPARKMatrix #FinanceTransformation #MarketIntelligence