Market Overview

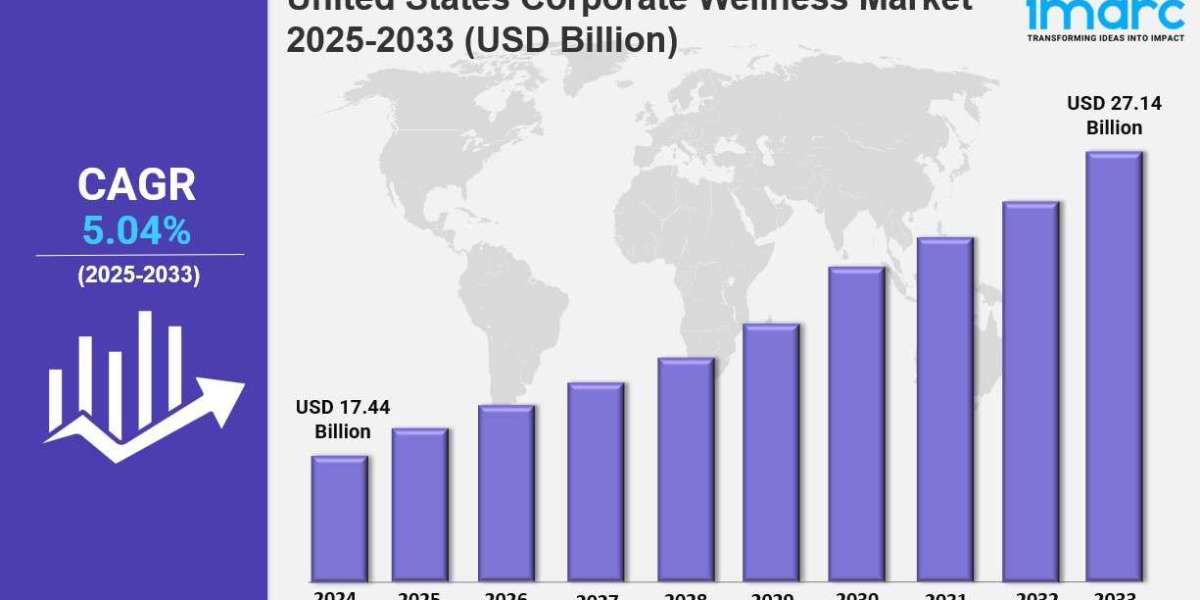

The United States Corporate Wellness Market Size was valued at USD 17.44 Billion in 2024 and is projected to reach USD 27.14 Billion by 2033, growing at a CAGR of 5.04% during the forecast period of 2025-2033. This growth is driven by employers' increasing focus on improving worker health to boost productivity and reduce absenteeism. The rise in awareness of mental health issues and the shift towards remote and hybrid work have accelerated demand for virtual wellness solutions, enhancing program access and customization.

Study Assumption Years

- **Base Year:** 2024

- **Historical Years:** 2019-2024

- **Forecast Period:** 2025-2033

United States Corporate Wellness Market Key Takeaways

- Current Market Size: USD 17.44 Billion in 2024

- CAGR: 5.04% during 2025-2033

- Forecast Period: 2025-2033

- Employers increasingly acknowledge the correlation between employee health and productivity, driving wellness spending.

- Rising healthcare costs compel businesses to adopt corporate wellness programs focusing on disease prevention.

- Shift to remote and hybrid work models has boosted virtual and flexible wellness program adoption.

- The market sees widespread adoption of health risk assessment services, constituting 21.7% of the market in 2024.

- Large-scale organizations dominate with 67.5% market share due to greater resources and strategic interest.

Sample Request Link: https://www.imarcgroup.com/united-states-corporate-wellness-market/requestsample

Market Growth Factors

The United States corporate wellness market is significantly driven by increasing employer awareness of the link between worker health and workplace productivity. Businesses recognize that healthier employees exhibit higher productivity, less absenteeism, and contribute to a better work environment. This motivates companies to invest in programs addressing physical health, mental well-being, and preventive care, especially given stresses like long working hours and high stress levels prevalent in the US workplace. The growing demand for whole-person wellness solutions aids employees in managing chronic conditions and balancing work-life pressures, further advancing market growth.

The rising healthcare costs in the US act as a major impetus for the corporate wellness industry. Employers face escalating medical expenses and insurance premiums, pushing the demand for affordable health maintenance alternatives. Corporate wellness initiatives aim to reduce these costs by focusing on disease prevention and early intervention. The high prevalence of chronic diseases such as diabetes, heart disease, and obesity is being targeted through wellness programs promoting healthy lifestyles and regular health checks. Regulatory frameworks like the Affordable Care Act (ACA) provide incentives for wellness adoption, encouraging evidence-based practices to sustain employee health and manage healthcare expenses effectively.

Another pivotal growth factor is the shift to remote and hybrid work arrangements which have stimulated the expansion of virtual wellness solutions. These include virtual fitness programs, mental wellness applications, and telemedicine services that enhance access and participation. Flexible and customizable wellness programs have become essential in catering to a dispersed workforce, increasing engagement and inclusivity. This trend supports the diversification of wellness offerings and complements onsite wellness initiatives, fostering consistent growth in the United States corporate wellness market by improving reach and convenience.

Market Segmentation

Analysis by Service:

- Health Risk Assessment: Largest segment with 21.7% market share in 2024; pivotal for early detection of health risks and tailored wellness planning.

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

Health risk assessments form the foundation for preventive healthcare, enabling employers to devise specific wellness strategies that control long-term costs and improve productivity. They frequently integrate with electronic health platforms to support customized recommendations.

Analysis by Category:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers: Leading category with 50.2% market share in 2024; major drivers of wellness program implementation and funding.

Employers from small to large businesses invest in diverse wellness services to enhance productivity and reduce absenteeism, increasingly using digital and flexible program formats especially given hybrid work trends.

Analysis by Delivery:

- Onsite: Dominant delivery mode with 58.7% market share in 2024; offers immediate, personalized health support at workplaces.

- Offsite

Onsite wellness initiatives include exercise centers, health screenings, vaccination clinics, and mental health counseling, fostering higher employee engagement and community spirit, particularly prevalent in large, concentrated workforces.

Analysis by Organization Size:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations: Market leader with 67.5% share in 2024 due to more resources and capacity for comprehensive wellness programs.

Large enterprises provide extensive wellness offerings including on-site facilities and customized interventions, influencing industry-wide wellness standards and serving as a benchmark for effective health initiatives.

Regional Insights

The Northeast region leads in adopting corporate wellness initiatives due to the presence of large financial, healthcare, and technology corporations. High workplace stress has underscored mental health services and prevention as priority areas. Urbanization and competitive labor markets in the Northeast foster innovation in wellness services tailored to diverse employee needs, making it the dominant regional market.

Recent Developments & News

- June 2025: Amazon expanded global mental health support, receiving Mental Health America's Platinum Bell Seal for the third time, offering 24/7 counseling, self-service tools, and single-session consultations via Northwestern University partnership, covering over 130,000 employees and 33,000 managers across 60+ countries.

- June 2025: Deloitte US updated its wellness subsidy program, allowing employees to spend up to $1,000 annually on stress-relief items like Lego sets, puzzles, and gaming consoles to ease workplace stress and support well-being.

- January 2025: Bank of Baroda partnered with Truworth Wellness to enhance employee assistance programs focused on mental, emotional, and psychological health, providing private therapy on stress and anxiety to over 75,000 workers and their families.

Key Players

- Amazon

- Deloitte US

- Bank of Baroda

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20536&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302