IMARC Group has recently released a new research study titled “South Korean Animation Market Size, Share, Trends, and Forecast by Revenue Source and Region, 2025-2033”, which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Animation Market Overview

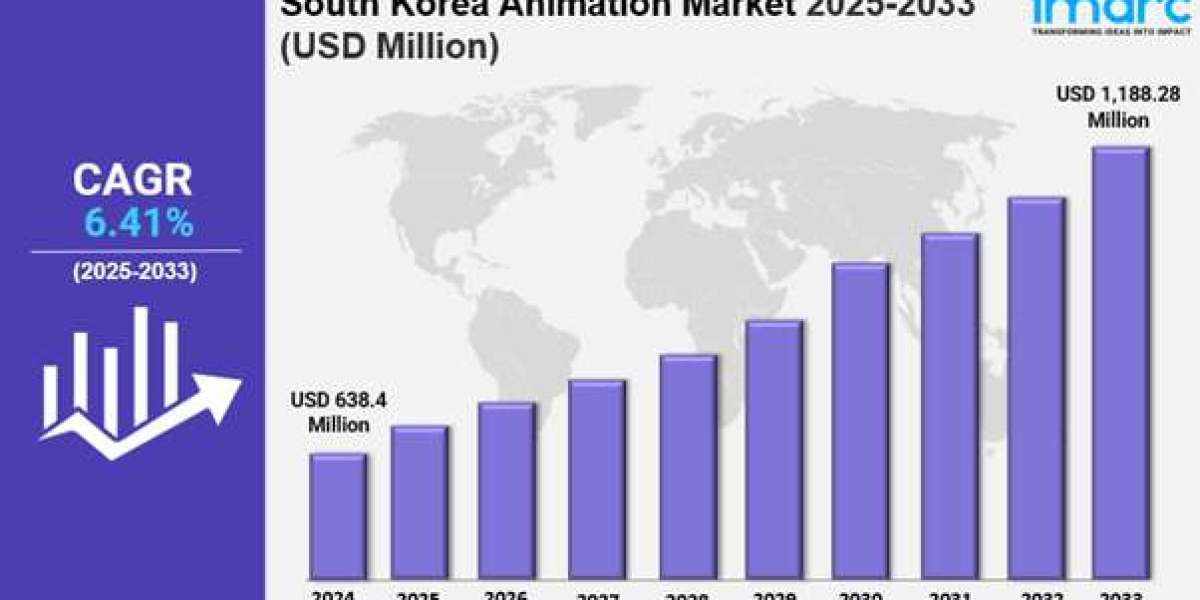

The South Korean animation market size reached USD 638.4 million in 2024. The market is projected to reach USD 1,188.28 million by 2033, growing at a compound annual growth rate (CAGR) of 6.41% from 2025 to 2033. Private schools and tutoring programs are offering animation-style drawing classes, attracting young people seeking careers in animation and gaming. With a growing youth population and increasing social media users, animation trends are rapidly spreading, driving demand. These strong cultural and creative connections are driving the growth of the South Korean animation market.

Market Size and Growth

- Base Year: 2024

- Forecast Years: 2025-2033

- Historical Years: 2019-2024

- Market Size in 2024: USD 638.4 million

- Market Outlook for 2033: USD 1,188.28 million

- Market Growth Rate (2025-2033): 6.41%

Request for a sample copy of the report: https://www.imarcgroup.com/report/ko/south-korea-anime-market/requestsample

Key Market Highlights

✔️ Strong growth driven by increasing demand for digital content and streaming platforms

✔️ Rising popularity of animated films, series, and webtoons among all age groups

✔️ Expansion of domestic and international collaborations in animation production

✔️ Growing adoption of 3D animation, CGI, and virtual production technologies

✔️ Increasing merchandising, licensing, and e-learning applications of animated content

Trends in the South Korea Animation Market

One significant trend in the South Korea animation market is the rapid growth of streaming services. As more consumers turn to digital platforms for entertainment, animation studios are focusing on creating exclusive content for these channels. By 2025, it is expected that partnerships between studios and streaming services will become more common, enhancing content accessibility and viewer engagement.

Additionally, the popularity of webtoons is transforming how animated stories are created and consumed. Many webtoons are being adapted into animated series, appealing to a younger audience and expanding the market further.

Moreover, the South Korea Animation Market is anticipated to grow as international collaborations increase. Co-productions with foreign studios are becoming more prevalent, allowing for a blend of creative ideas and broader audience reach.

Market Dynamics of the South Korea Animation Market

Growing Popularity of Anime

The South Korea animation market is significantly influenced by the rising popularity of anime, which has garnered a massive following both domestically and internationally. This trend is expected to continue, with more local studios producing anime-style content.

Innovative Storytelling Techniques

Another key dynamic shaping the South Korea animation market is the introduction of innovative storytelling techniques. Creators are experimenting with unique narratives and animation styles to cater to diverse audience preferences, enhancing the overall viewing experience.

Competitive Pricing and Brand Loyalty

Competitive pricing is crucial in the South Korea animation market, as consumers often compare content based on quality and price. Brands that offer high-quality content at competitive rates are likely to gain a competitive edge.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=40097&flag=C

South Korea Animation Market Segmentation

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, distribution channel, and region.

Type Insights:

- TV

- video

- video

- Internet distribution

- Merchandising

- music

- pachinko

- Live entertainment

Regional Insights:

- Seoul metropolitan area

- Yeongnam (southeastern region)

- Honam (southwestern region)

- Hoseo (central region)

- etc

Competitive Landscape

The market research report provides an in-depth analysis of the competitive landscape, covering market structure, key player positioning, and top winning strategies. Detailed profiles of major companies are included, highlighting their product offerings and market strategies.

Key Highlights of the Report

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current, and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients across sectors to identify high-value opportunities, address critical challenges, and transform their businesses.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1-201-971-6302